Monday Market Report - Sep 12 to Sep 18, 2022

BTC, ETH & more

📢 Market Updates

- Flashbots build over 82% relay blocks, adding to Ethereum centralization.

- Despite the prolonged bear market and an evident dip in cryptocurrency prices, celebrities continue to pour in support for the crypto market.

- Crypto holders in China are protected by the law in case of theft, misappropriation, or breach of a loan agreement despite the ban on crypto.

📻 Crypto News

REGULATORY

- Regulatory Turf War A-Brewing Between the SEC and the CFTC –Blockworks

FUNDING

- Biden Executive Order on Crypto Follow-Up Provides Very Little News – CoinDesk

INDUSTRY NEWS

- Is Do Kwon On The Lamb? South Korea Issues Arrest Warrant – CoinDesk

- After 7 years of Hard (Proof-of) Work, Ethereum Retires to Proof of Stake: RECAP – Blockworks

- Wall Street, Silicon Valley Throw their Hats in the (Crypto) Ring: Launch EDX Markets – CoinDesk

📝 Key Notes

- The Merge upgrade successfully completed last week. Ethereum (ETH) moved into a proof-of-stake (PoS) consensus mechanism.

- Bitcoin is down close to 60% year-to-date and now faces a strong psychological resistance of C$27,000.

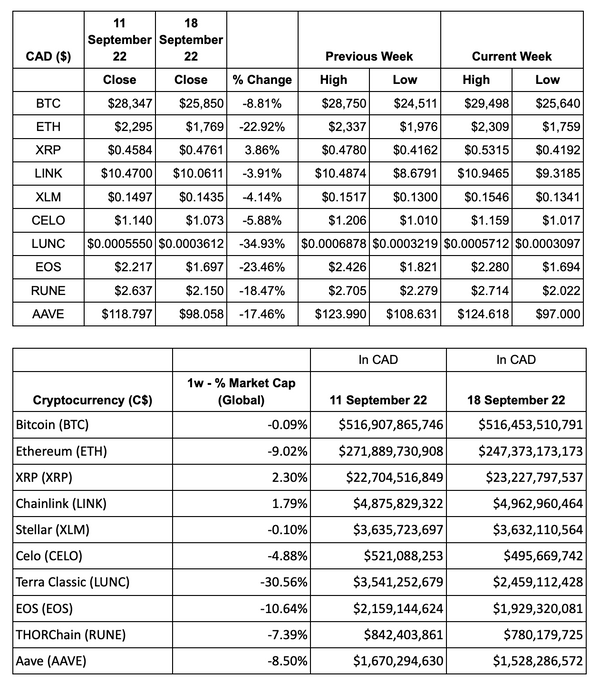

📊 Cryptocurrency Overview

The Merge upgrade was successfully completed last week. Ethereum (ETH) moved into a proof-of-stake (PoS) consensus mechanism, resulting in a far more energy-efficient ecosystem being built.

The S&P 500, and Nasdaq suffered their worst performance, as investors remain bearish due to the repeated rate hikes by the FED, in order to curb US inflation. The aggressive monetary policy that has been adopted, has limited the market potential, as the macroeconomic environment continues to drive investors away. Bitcoin (BTC) is closely correlated to the S&P 500 and has fallen over 10% week on week. If this correlation continues, it could bring more pain to the cryptocurrency markets. This uncertainty has kept investors on the edge.

Due to macroeconomic factors, equities markets are seeing rapid liquidations and a rather strong sell-off, which is adding downward pressure on Bitcoin and altcoin prices. The World Bank has signaled the possibility of a global recession in early 2023. In a press release on Sept. 15, it said that with the current pace of rate hikes and policy decisions, it is unlikely to bring inflation down to pre-pandemic levels. Bitcoin is down close to 60% year-to-date and now faces a strong psychological resistance of C$27,000.

📈 Bitcoin Technical Analysis

BITCOIN was trading in a ‘Rising Channel Pattern’ and after facing stiff resistance at the upper trendline of the pattern it witnessed a sharp correction and broke the pattern on the downside reaching a low of C$24,511. Though BTC gave a breakout on the downside, it did not test the previous bottom of C$22,950 and reversed from C$24,511. The asset showed signs of recovery and rallied up to the C$29k mark. BTC is facing strong resistance around C$29,000 (Upsloping Trendline of the 'Rising Channel’).

Disclaimer: This content is not intended to provide investment, legal, accounting, tax, or any other advice and should not be relied on in that or any other regard. The information contained herein is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of cryptocurrencies or otherwise.