For the first time in almost 3 months, Bitcoin topped $48,000 US

The price of Bitcoin recovered over the weekend after its heavy drop in June and July. Bitcoin’s rise lifted the value of the entire cryptocurrency market above $2 trillion last Saturday for the first time since mid-May. Jehan Chu, the founder of cryptocurrency-focused VC and trading firm Kenetic Capita, says that the regulatory changes in China (which forced miners to stop) and the infrastructure bill passed by the U.S senate last week have “clipped the market’s wings”. He also mentioned that investors should expect a “significant pullback to sub-$30,000 levels, resetting the stage for a long steady march”.

China’s crackdown has upped bitcoin mining revenue by $35 million per day

After the crackdown in June, most of China’s miners were taken offline. The ones that stayed online have now grown their income by 57% per hash. The crackdown took almost 90% of miners offline and Chinese banks were ordered by the government to cut ties with miners as well. Thus, the miners had to look for a new place to bring their business.

They started to provide computing power to the network and generated BTC rewards for themselves. This resulted in hashrates falling by almost 50%. In addition, more BTC was flowing to miners outside China. Due to the fall of Bitcoin price in USD, miners weren’t cashing out their coins. This could have had a direct impact on how the BTC price has risen by $17,000 USD in the last month.

Read the full story on Decrypt

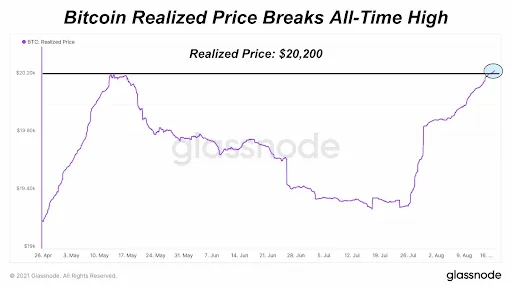

There is a new all-time high for the realized price of Bitcoin

After reaching its highest realized price on May 12 earlier this year, the realized price of Bitcoin took a downfall. However, it has currently been estimated at $20,200. The realized price is calculated by dividing the realized capitalization by the circulating supply. The realized price can be more beneficial compared to the investor activity on the network since it quantifies when Bitcoin is changing hands. Two factors have made the comparison of the market value to realized value ratio very attractive. First, the increase in the realized price, and second, Bitcoin being at 27% below the ATH price set in April.

Read the full story on Bitcoin Magazine

Fidelity has announced skyrocketing institutional demand for BTC

After reaching its low on July 20th, BTC has gained over 63% and this has resulted in accelerated institutional interest. The announcement by Fidelity implied that interest in accessing a new digital asset class has peaked with the company’s biggest clients.

Tom Jessop, the head of the crypto arm of the firm, has said that governments around the world printing money due to the COVID-19 pandemic was one of the largest motivators for investors to get into cryptocurrency. Fidelity plans on building a solid infrastructure for its investors to access Bitcoin and other digital assets directly.

Read the full story on FXSTREET

First-ever mortgage plan to be paid in Bitcoin

US-based United Wholesale Mortgage (UWM) has announced that they are implementing a plan that allows their customers to pay their loans in Bitcoin and other cryptocurrencies. In addition, they have stated that they plan on executing their plan this year and be the first mortgage lender in the United States to accept bitcoin for loan payments.

UWM hasn’t been the only company to express its interest in digital assets. Mogo, a Canadian-based digital payments company said earlier this year that they would be extending their Bitcoin cashback rewards to include mortgages as well.

Read the full story on Cryptodaily

Fundstrat says that Bitcoin is going to reach $100,000 US by the end of the year

On monday, the Bitcoin price reached $46,000 US which was its highest since May. Fundstrat Global Advisors believe that it will reach $100,000 by the end of 2021.

Read the full story on GetNews