Market Fundamentals Analysis

Crypto had a slow weekend, with BTC up about 1.5% on a miniscule 28% vol. ETH has been doing a little better, up 3.5%, a modest bounce off a crucial level. One of the challenges of trading crypto, or any alternative asset, is determining when the market is being dictated by alpha or beta; in other words, if the idiosyncratic catalysts of a product are moving it, or if the product is moving because of the winds of macro markets. For example, the current doldrums of crypto markets are mostly being attributed to the LUNA meltdown, but something else happened in that same week: NASDAQ traded at the lowest price since Nov 2020. (It’s not even a coincidence that these two things happened in the same week. Equity weakness drove BTC weakness drove LUNA weakness triggered a death spiral in LUNA/UST.)

Since the week of May 9, equities have bounced… not convincingly, but they have created some breathing room off the lows. Crypto has not. While BTC has hugged tight to the C$38k level, it still remains one bad day away from fresh lows and “Is Bitcoin dead?” narratives. It’s tempting to ascribe this as idiosyncratic to crypto; the LUNA meltdown has cooled investors on crypto, making BTC’s recovery lag. Which brings us to ETH, and by extension alts. Before the week of May 9, ETH-BTC was trading .075 and trading in the right direction, with all the strength of the Merge narrative behind it. During that week, it traded down to .067, and since then it has moved even lower. Once again, it’s tempting to search for idiosyncratic reasons for ETH’s underperformance for example a block reorg on the Beacon chain, and/or potential delays to the Merge. But at the end of the day, it seems like it’s Beta, not Alpha, leading ETH to underperform here.

And ETH is not the end of the risk curve; as you go out further, you see assets performing worse. SOL, of course, has been getting hammered, and again it’s tempting to point towards the outages Solana has seen. However, its -48% performance since May 9 has it moving almost in lockstep with other alternative L1s, such as AVAX and NEAR. In the L1 space, it’s the coins that have been around the longest, and thus have the largest retail pickup, that have done the best in this risk-off environment: ADA, XTZ, DOT and, yes, ETH. It seems somewhat likely that this week will be another where the crypto markets will be driven by Beta, not Alpha. With Consensus taking place in Austin, it could be a fairly quiet week, or at least as quiet as the macro markets will allow.

Moreover, a robust US jobs report last week, coupled with rising oil prices further fuelled the narrative of the Fed looking to maintain its assertive stance on inflation. Global equities dipped and crypto majors traded range bound with BTC and ETH continuing to hover around the C$38k and C$2.3k range. Flows continue to be centred around the rotation of Alts into BTC, and the past couple of sessions have seen some fund redemptions and net selling accordingly. Derivative flows were light post last Friday’s expiry and realized vols continue to trend lower with ETH in particular underperforming.

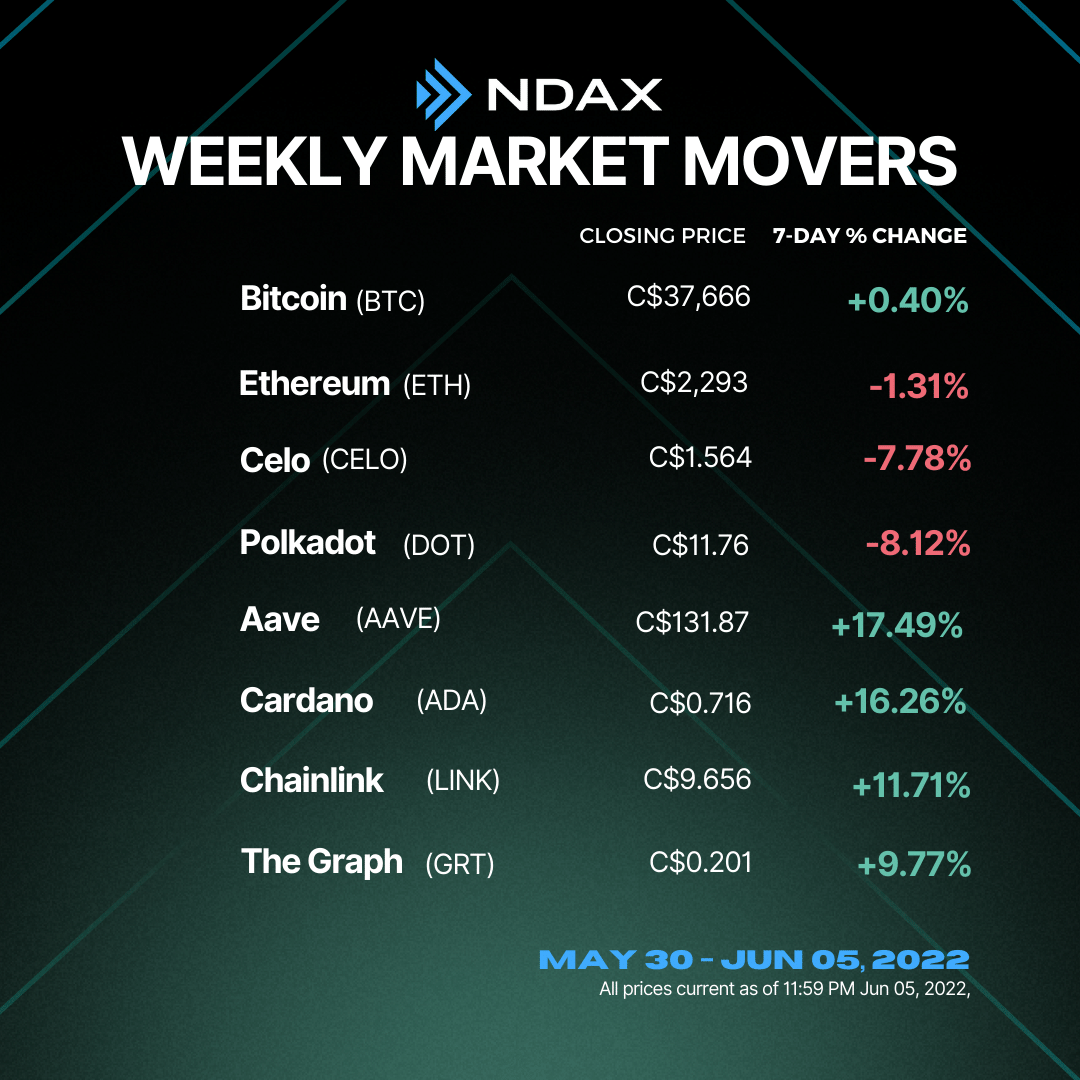

Weekly Snapshot

Market Updates

- Since January, Bitcoin ATM installations have seen a gradual slowdown, eventually falling 89.75% from December 2021’s 1,971 new installations.

- Yuga Labs, the creator of two of the most popular ape-themed nonfungible token (NFT) offerings — Bored Ape Yacht Club (BAYC) and OtherSide — witnessed yet another orchestrated phishing attack, with investors losing over 145 Ether (ETH) or nearly $260,000 at the time of writing.

- The Bermuda government is pushing on with its ambitious plans to become a cryptocurrency hub despite the massive market downturn in 2022.

- South Korea’s Financial Supervisory Service (FSS) began an investigation into payment gateway services that work with digital assets.

BTC Technical Analysis

BITCOIN after trading in red for nine consecutive weeks has finally managed to give a weekly closing in green and have not made a ‘Lower Low’. The asset has taken multiple support at C$35,500 in the past and this time too, the bulls are trying to defend the level. Technically, on a daily time frame, after making a ‘Long Legged Doji candle at the low of C$33,095, BTC is trading sideways in a range between C$36,000 to C$40,000 with declining volumes. Once a breakout and a daily close occurs above C$40,500 with good volumes then we can expect it to further surge up to C$45k - C$47k whereas a close below C$35,500 will lead to further downfall. Flat Moving Averages and RSI around 50 indicates neutral stance for the asset.

KEY LEVELS: