Weekly Crypto Market Report: Nov 8-14, 2021 - BTC, ETH, DOT, SHIB & More

Market Fundamentals Analysis

Most assets have seen some form of consolidation after hitting all-time highs last week. The overall crypto space is currently valued at $2.81T vs $2.9T when BTC and ETH hit all-time highs. After the US Bureau of Labor Statistics saw a sharp 6.2% annual rise in its CPI last week, the highest in 30 years, both BTC, and ETH saw a rally set in almost immediately and hit ATH’s of C$85,999.98 and C$6,098.13 respectively. BTC and ETH are similar to what we see in Gold prices, which lept ~5%. This is not surprising as higher-than-expected inflation triggers a reaction to accumulate scarce assets. However, since then traders began to book profits, causing more than a -C$8,000 drop amongst the sell-off, which led to BTC prices falling below C$78,306 and put an end to ETH’s upward rally. Volumes however seem to show no respite, and we continue to see strong inflows across both these assets. This is probably due to the fact that any correction from these levels makes both BTC and ETH look like attractive assets.

For assets like Gold/BTC/ETH, a hawkish Fed signals a deflationary pressure which is a result of less bond buying and higher rates. This reduces the relative utility of a scarce asset. This may result in a short-term rally, specifically in crypto. Post-announcement speculation, driven by leverage, as is evidenced by spikes in BTC perp funding rates from the +3-5bps range to +5-7bps. We might touch some new ATHs in the near term but they may fade in the intermediate and long-term, given this macro deterioration.

On Saturday, the SEC rejected VanEck’s proposal for listing a spot Bitcoin ETF. SEC said that the proposed ETF failed to meet requirements, which notes that the foundation of a national securities exchange must be “designed to prevent fraudulent and manipulative acts and practices.” The decision was widely anticipated given SEC chair Gary Gensler’s outspoken preference for a Bitcoin futures ETF as opposed to spot. Aside from a bullish Barry Silbert tweet earlier this week, spot ETF approval rumours were hardly corroborated anywhere else. This largely contrasts the hype we saw around the anticipated approval of ProShares’ futures ETF less than a month ago. Given the predicted rejection of the spot ETF, the news hardly impacted the price of Bitcoin. A brief dip of less than 1% was seen by a surge upward as BTC has pushed back within minutes.

Polkadot parachain auctions kicked off in earnest on Friday, after crowd loans had been accepting contributions since November 4, 2021. Heading into the week, Acala was leading the competition, with $450mm worth of DOT contributions. In second place, Moonbeam raised an impressive $264mm, still miles away from Acala. Like the Kusama parachain auctions, it seems like the Polkadot auctions were heading towards the same conclusion as Acala's sister project Karura which won Kusama's first auction with $209mm KSM pledged while Moonriver, Moonbeam's relative, won the second auction with $86mm of KSM. However, the week has surprised and the tables have turned. Moonbeam has leapt over Acala in the league tables with $973mm of DOT pledged to Acala's $792mm.

Shiba Inu has also seen a 15% appreciation over the weekend, as investors appear to be factoring in the news that AMC Entertainment Holdings (NYSE: AMC) might be considering accepting SHIB at payment at the company's theatres. Another interesting asset this week has been Litecoin. Although no fundamentals can be directly attributed to the current bullish mood in Litecoin, the LTC network has been witnessing a spike in its on-chain activity, as well as significant renewed interest amongst investors. The asset price had been pumped over 40% in the last few days, and also hit new highs of C$369.06.

Weekly Snapshot

Market Updates

- Austrian authorities have indicated their intention to tax gains from digital asset investments just like those from stocks and bonds. The move is expected to increase trust and access to cryptocurrencies.

- The Ethereum Name Service (ENS), the entity that controls the decentralized domains built on top of Ethereum, announced it would pivot to a decentralized governance model, opening the door to the formation of a DAO.

- Terra, an algorithmic stablecoin project, will burn $4.5 billion worth of terra (LUNA), its native token, from its community pool.

- Crypto intelligence platform reveals that a large percentage of Shiba Inu holders are still in the green, considering that the meme coin has pullback from its all-time high.

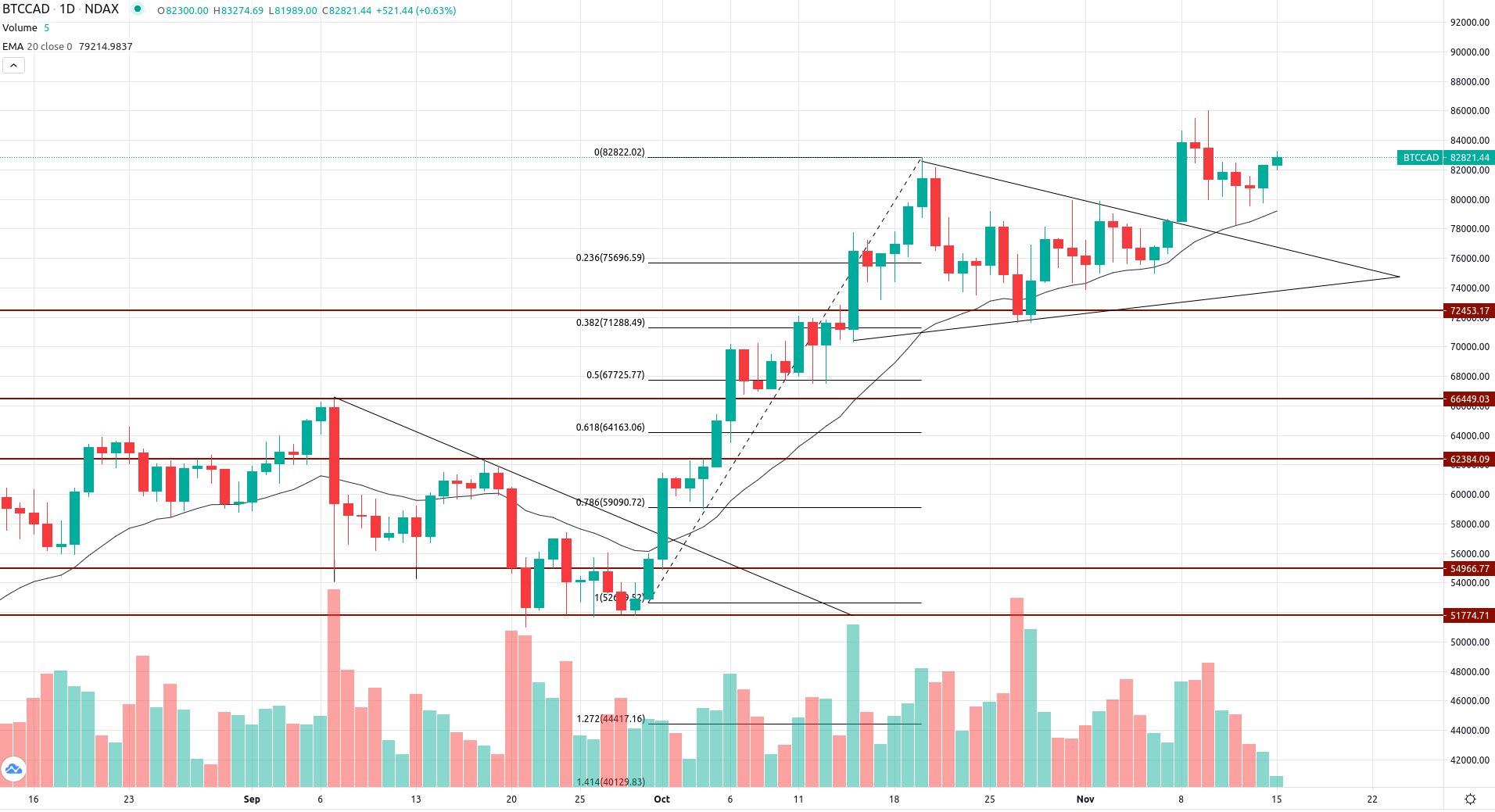

Bitcoin Technical Analysis

Bitcoin after consolidating gave a breakout on the upside and made the new all-time high of C$85,999. However, the asset was not able to sustain and give a close above C$85k and witnessed minor profit booking. Technically, on the daily time frame, BTC is making ‘Spinning Top’ candles at higher levels and as well as at support levels with declining volumes which indicates indecision. Currently, Bitcoin is trading in a range from C$83,000 to C$80,000 but the good sign is that the prices are constantly taking support at 20 Day Moving Average and the asset is still in a bull run on higher time frames. To further rally BTC needs to trade and close above the recent high whereas a close below C$75,000 can lead to some panic selling.

For the latest cryptocurrency prices, check out NDAX's Markets page.

Disclaimer:

Information provided in the weekly market report is for information purposes only and should not be interpreted as investment, legal, or tax advice. Prior to investing, it is very important to evaluate your investment objectives and your risk tolerance carefully. This technical report is not meant to provide guarantees of future performance, and users should not rely on it, as the actual performance and financial results may differ significantly.