A Beginners Guide to Bitcoin: The Canadian Crypto Ecosystem

According to research published in 2018 by the Bank of Canada titled “Bitcoin Awareness and Usage in Canada,” five percent of Canadians own Bitcoin.

Introduction

Melanie Swan, a technology theorist in Philosophy at Purdue University says, “There is something new and fundamental happening in the world which could be the start of the next enlightenment period. The core of this is shifting from centralized to decentralized models in all aspects of our lives, both individual and societally.”

In this blog, I highlight the Canadian financial and cryptocurrency ecosystem and explain everything Canadians need to know to get started.

What is Cryptocurrency?

Cryptocurrency in its simplest form is an internet-based medium of exchange that uses blockchain technology to function. Blockchain enables cryptocurrencies to be decentralized, transparent, and immutable.

But what is Bitcoin?

Bitcoinhttps://ndax.io/learn/what-is-bitcoin-btc?ref=ndax.ghost.io is the first-ever cryptocurrency and by far the biggest by market capitalization—meaning that the total dollar market value of Bitcoin is more than any other cryptocurrency.

The supply of Bitcoin is limited to 21 million— meaning there can never be more than 21 million Bitcoins. The number of Bitcoins in circulation right now is 18.5 million.

Why should you invest in Bitcoin?

An ideal currency in a digital age like ours should have three main characteristics:

- It shouldn't be under the control of authority so that it isn’t manipulated and printed at will.

- The currency should be borderless so that it can be exchanged throughout the globe without the help of a middleman.

- It should be apolitical and not in favor of a specific group of people.

Everyone alive today is born into the existing system of government-issued money (also known as Fiat currency) which is why most people accept that the gradual rise in prices for everything from bread to college tuition is a natural phenomenon. It’s not.

The problem Bitcoin solves

Bitcoin solves the problem of Inflation. With its limited supply and decentralized nature, Bitcoin makes for one of the best store-of-value assets similar to Gold. Here’s a very interesting and detailed report by Grayscale Investments LLC on ‘Valuing Bitcoin.’

Inflation and geopolitical instability are big drivers in the recent trend of companies adding Bitcoin to their balance sheets. In 2020, the US companies MicroStrategy and Square invested $425 Million and $50 Million respectively in Bitcoin.

The current pandemic that has hit the world, strengthens the case for Bitcoin even further because central banks all over the world are printing and pushing more and more money into the economy to keep businesses running and people employed.

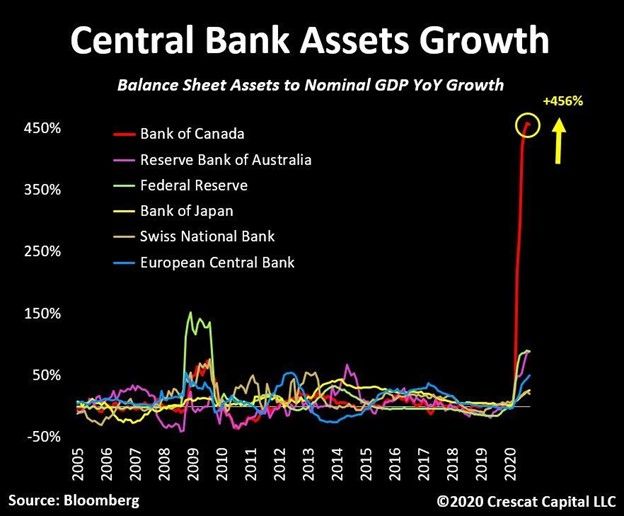

Taking a look at the Canadian Balance sheet, we can see a frightening 456% increase in the balance sheet assets to Nominal GDP growth, while this provides the economy with temporary life support, it paints a gloomy picture of the future of the Canadian dollar.

How can Canadians start trading Bitcoin?

The best way to get involved is to Dollar Cost Average (DCA) into Bitcoin. A common misconception is that you have to buy a whole Bitcoin. 1 BTC to CAD at the time of writing this is a little below $15,000.

You can buy part of a Bitcoin for as little as $1 depending on the exchange you’re buying from. One Bitcoin is divisible into one hundred million units called Satoshis or Sats —meaning that 1 BTC is equal to 100,000,000 Sats.

How to buy Bitcoin in Canada?

The Bitcoin network has been running securely for over 10 years now, long gone are the days when you could use your computer’s graphics card to mine some Bitcoin. The good news is that you don’t need a supercomputer to own Bitcoin anymore.

There are multiple Canadian exchanges available that you can use to buy Bitcoin, but before making a choice you need to look at the following points:

- Security of the platform

- Custody

- Regulation & Banking

- Closed-loop vs open-loop exchanges

- Fees

Ndax review

The National Digital Asset Exchange (Ndax) is registered with the Financial Transactions and Reports and Analysis Centre of Canada (FINTRAC) and Autorité des marchés financiers (AMF) as a Money Service Business (MSB).

Ndax has obtained a banking relationship with a Canadian Crown-owned financial institution, with insurance protection for user funds. This is important if you want to get your money back in case the exchange is hacked, and the funds are stolen.

Ndax also holds the majority of digital assets, offline in cold storage which mitigates the risk of cyber hacks even further.

Ndax was also able to secure banking services from the same institution so that fiat deposits don’t need to be sent offshore or held in non-regulated institutions.

More importantly, Ndax runs an open-loop system—meaning that users can withdraw their purchased assets to non-NDAX addresses. Personally, I thought this was a standard for any exchange but surprisingly realized that it's more of a feature.

The coins listed on Ndax are Bitcoin, Ethereum, Litecoin, Tether, XRP, EOS, Stellar, Dogecoin, Cardano and Chainlink.

Ndax has a very straightforward fee structure. All deposits are free. The platform charges 0.20% trading fees which are very standard and have flat fee withdrawal fees that vary depending on the asset.

WealthSimple Crypto review

WealthSimple is very popular in Canada for its equity investment and stock trading products, they have recently released cryptocurrency trading. However, its cryptocurrency trading platform WealthSimple Crypto (WSC) has some limitations.

WSC is registered as a Restricted Dealer with the Canadian Securities Administrator’s Regulatory Sandbox. This restricts the platform from providing services that a registered MSB can provide.

Assets purchased and held on WealthSimple Crypto are not protected by insurance.

Users can only purchase Bitcoin and Ethereum on WSC. The platform runs a closed-loop system that does not let users withdraw Bitcoin and Ethereum. This makes the exchange only good for short-term trading and not preferable for long-term investing.

WealthSimple boasts zero withdrawal, deposit or trading fees, but charges a spread in market prices to accommodate for that. , means that if the current market price of Bitcoin is $15,260 CAD, the WSC market price for Bitcoin will be $15,530 CAD. Although this usually matches up to the normal fees charged by other exchanges, I prefer to know exactly how much fees I am paying for every transaction.

Closing Thoughts

Many prominent analysts, researchers, and theorists believe that Bitcoin and Blockchain are innovations of the century and are on the way to completely transforming our society starting with finance.

It is not too late to invest in Bitcoin and it never will be. But the earlier you start, the earlier you will see the results. Starting with Ndax is easy: Sign up, fund your account, and start trading Bitcoin and other cryptocurrencies like Ethereum, XRP, Litecoin, Cardano, Dogecoin, EOS, and Stellar.