BitcoinBites: 5 BTC stories you should know – January 12th, 2022

‘Seized The Opportunity’: Canada’s Bitfarms bought $43 million in Bitcoin during $300 billion crypto crash

Canadian bitcoin mining company Bitfarms announced Monday it invested $43.2 million in bitcoin as the cryptocurrency plummeted about 12% during the first week of the year, becoming the latest publicly traded company doubling down on the nascent crypto market despite some experts warning its volatility makes it an unreliable investment.

Bitcoin rises as inflation hits 7%

US inflation has reached an expected 7% in December according to the latest data by the US Bureau of Labour Statistics. It said:

“The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.5 percent in December on a seasonally adjusted basis after rising 0.8 percent in November. Over the last 12 months, the all items index increased 7.0 percent before seasonal adjustment.”

That’s roughly in line with what was expected for the month, with Bitcoin rising to nearly $44,000 following the official release.

How Spiral, Jack Dorsey's rebranded Bitcoin company is accelerating adoption

Jack Dorsey’s popular financial company Square went through a recent rebrand and is now called Block. The move led one of its subsidiaries, Square Crypto, to also take up a fresh name. Now known as Spiral, Block’s Bitcoin company has set out on a well-defined mission: to advance Bitcoin toward worldwide use.

WHAT’S IN A NAME?

In its rebranding statement, Spiral noted that its original name had never fit it well. The inclusion of its parent company’s former name within its own led people to believe the connection between the two was stronger than it actually was, and this caused confusion around Square Crypto’s independence. Furthermore, the presence of “crypto” misrepresented its mission, the company said, since it is focused solely on Bitcoin. Spiral also alludes to Bitcoin as it continues to grow “like a spiral from a single point, encompassing more and more space until it touches everything,” per a Square tweet.

Jack Dorsey proposes non-profit fund for Bitcoin developers

Jack Dorsey has announced a new Bitcoin legal fund that would be targeted at developers of the asset. This is not the first time that former Twitter CEO Jack Dorsey has been associated with a number of charitable works in the crypto space.

Around November, celebrity dance show Dance-a-Thon received $2 million from Mr. Dorsey. He’s also rumored to have donated about $20 million of Square’s shares to charities. The announcement of a newly proposed non-profit Bitcoin legal defense fund is another addition to his growing list of philanthropic gestures in the space.

To start with, the fund will be providing defense for Bitcoin developers who Tulip Trading Limited is suing over an alleged “breach of fiduciary duty” regarding the theft of crypto from the Mt. Gox hack.

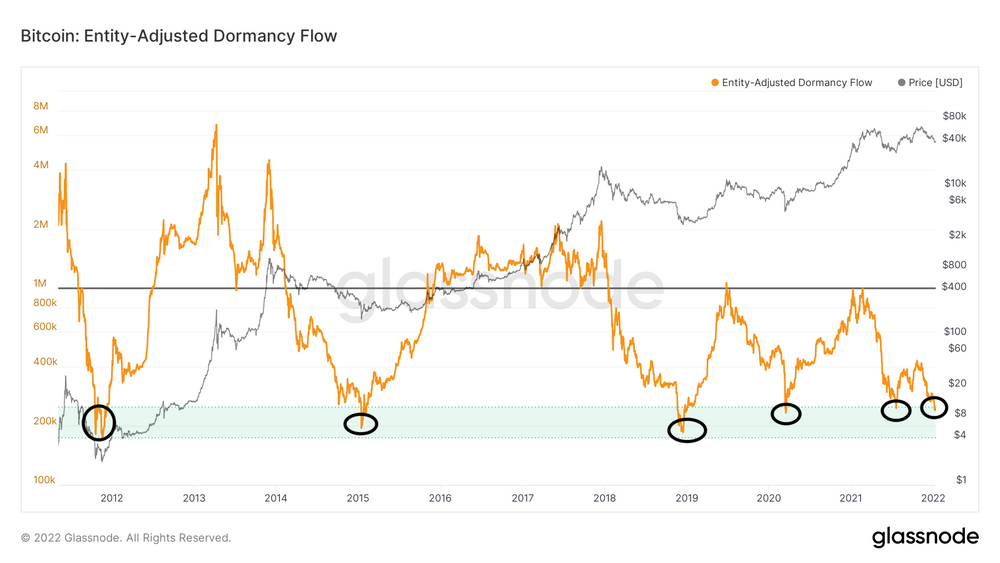

Blockchain indicator suggests Bitcoin could be close to bottoming out

- A historically reliable blockchain indicator suggests Bitcoin may be in the final stages of a bearish trend, having lost nearly 40% of its value in the past two months.

- The entity-adjusted dormancy flow, a ratio of cryptocurrency's going market value to the annualized dollar value of coin dormancy, has dropped below $250,000. Dormancy refers to the average number of days each coin transacted remained dormant or unmoved, a gauge of the market's spending pattern.

- The area under $250,000 has marked major price bottoms in the past, as seen in the featured image provided by data analytics firm Glassnode.

- "Entity-adjusted dormancy flow recently bottomed out, showing a full reset of the metric. These events historically print at the cyclical bottom," Glassnode said in a report published on Monday.

Read the full story on Coin Desk

For the latest Bitcoin prices, check out Ndax's BTC Price page