How will CBDC affect the blockchain tech company, Ripple?

How will CBDC's foray into the cross-border remittance affect the blockchain tech company Ripple, a platform that aims to transform the legacy institutions?

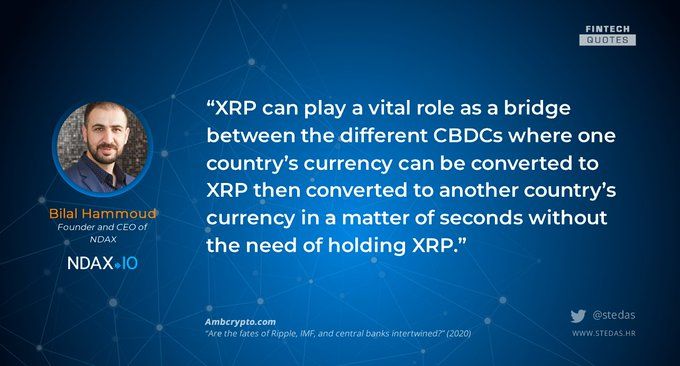

Ndax's CEO, Bilal Hammoud's statement on the impact of CBDC on Ripple, featured on AMBCrypto expanded.

Are the fates of Ripple, IMF, and central banks intertwined? ambcrypto.com

To understand the impact of CBDC on Ripple as a blockchain company one must consider the following:

The establishment of Bitcoin as a peer-to-peer e-cash system during the last recession of 2008 created a wave of innovation. This advancement in technology forced traditional legacy organizations to work with Blockchain infrastructure or risk being left behind. We saw this with JPMorgan Chase's CEO, Jamie Dimon who called Bitcoin a “fraud”, only to later regret his statement and invest in a blockchain fork based on Ethereum.

In 2019, we saw many governments and organizations start to explore the potential of issuing a centralized digital currency. This phenomenon was expedited in 2020 during a pandemic that left governments struggling to provide the necessary assistance to their citizens. We saw Democrats, in the House Committee on Financial Services in the United States proposing the creation of digital currency and digital wallets as part of the stimulus. The acceleration of such requests from the United States set the tone for “Central Bank Digital Currency (CBDC)” around the world. This news made waves through the cryptocurrency world as some people saw it as a way to expedite the adoption of cryptocurrency. Some cryptocurrency communities believe that CBDC will have a negative impact on companies like Ripple and Stellar for cross-border payment. At Ndax, we believe that the creation of CBDC will be beneficial to both Bitcoin and XRP.

The “catch-up” game. How will XRP benefit from CBDC?

- Ripple, led by Brad Garlinghouse, has been developing technologies such as Xcurrent and Xrapid for cross-border payments since early 2011. Ripple’s approach to modernizing payment systems by creating partnerships with traditional market players, has secured over 200 global partners, among these is the money transmittance giant Money Gram.

- Ripple’s ledger, XRP can process around 1500 transactions per second and can scale to match Visa's processing. The time-tested blockchain ledger along with international partners provides Ripple with an advantage over CBDC’s conservative approach to innovation. Traditional SWIFT transfers are more expensive and much slower, costing hundreds of dollars and sometimes taking weeks to process – whereas Ripple’s transactions are a fraction of the cost and process in seconds.

- During this pandemic, we learned that all global currencies are at risk of collapsing, including the US dollar. We saw currencies in Lebanon, Iran, Venezuela, and Argentina go through hyperinflation while US economy stimulus packages caused a lot of economic and geopolitical uncertainties. For cross-border payments, it has become increasingly important for banks to offload the risks of nostro/vostro accounts and the costs of hedging foreign currencies. XRP can play a vital role as a bridge between the different CBDCs where one country’s currency can be converted to XRP, then converted to another country’s currency in a matter of seconds without the need to hold XRP.

In summary, CBDC can be viewed as an upgrade to current fiat currency, which will save on printing costs, prevent counterfeit money, streamline distribution, and eliminate the need for stablecoins (such as the highly debatable Tether). In terms of cross-border payments, there will still be a need for a bridge currency such as XRP for settling transactions quickly and efficiently between countries.

If you are based in Canada and looking for a Canadian Bitcoin exchange, then take a look at Ndax. Ndax is an easy-to-use, beginner-friendly exchange that can give you easy access to trade Bitcoin and other cryptocurrencies like Ethereum, XRP, Litecoin, Cardano, Dogecoin, EOS, and Stellar.