Monday Market Report - Aug 22 to Aug 28, 2022

BTC, ETH & more

MARKET UPDATES

- Bitcoin threatens a 20-month low monthly close with a BTC price under $20K.

- MakerDAO co-founder recommends DAI-USD de-pegging to limit the attack surface.

- Risk assets take a major blow as Fed Chair Jerome Powell stays firmly hawkish on inflation and monetary policy.

- XRP price pumps and dumps amid mysterious $51M whale transfers.

CRYPTO NEWS

REGULATION:

- Tether Won’t Freeze Sanctioned Tornado Cash Addresses Without Authorities’ Request - CoinDesk

- SEC Chair Gensler’s Invitation For Crypto Firms to Meet with SEC ‘Rings Hollow,’ Execs Say - Blockworks

- US Rep. Tom Emmer Sends Concerned Letter to Yellen re: Unprecedented Tornado Cash Sanctions - Tom Emmer Twitter

INDUSTRY NEWS:

- Ethereum Merge Countdown: T-20 Days — Blockworks

- Crypto Prime Brokerage Enlists Former Wells Fargo, JPMorgan Exec - Blockworks

FUNDING:

- ‘The Sims’ Creator Will Wright Raises $6M for Blockchain Games — BlockworksPolygon

- Founder Raises $50M For Web3 Fund — Blockworks

CRYPTOCURRENCY OVERVIEW

Over the last few days, Bitcoin and several other altcoins followed stocks and fell after hawkish statements came from the FED. This confirms that the central bank remains serious about reducing inflation. FED chairman, Jerome Powell cautioned that this restrictive policy will remain for some time, stating that this might “bring some pain to households and businesses.”

The US equity market took this news negatively, with the Dow Jones Industrial Average dropping upwards of 600 points. Cryptocurrency markets saw nothing different, down close to 9% on average since the statement was made, with Bitcoin (BTC) and most altcoins threatening to break below their immediate support levels. Crypto didn’t respond well to the drop, but in Beta terms, it held up better than the past few weeks would have predicted. For example, BTC sold off almost twice as much on the previous Friday. The release of information about a law firm allegedly working closely with Ava Labs to aggressively litigate against rival blockchains caused AVAX to plummet almost 20% over the weekend – a record low since July 14th.

Struggling to hold at C$26,500, Bitcoin (BTC) looked set to equal its lowest monthly close since 2020 on Aug. 28th. The BTC/USDT pair failed to make up for lost ground over the weekend. Meanwhile, a sign of encouragement came from on-chain data covering HODL-er profitability. The fall that took place decreased the amount of BTC supply in profit, and that proportion is now approaching levels only seen in previous macro market bottoms. This indicates that HODL-ers continue to cold-store the BTC supply with increasing conviction, signaling strong confidence in the asset.

On major derivatives exchanges, we are currently seeing about $35B/day of BTC and a similar amount of ETH printing each day. Merge-related trades have certainly been a catalyst for heightened ETH volumes.

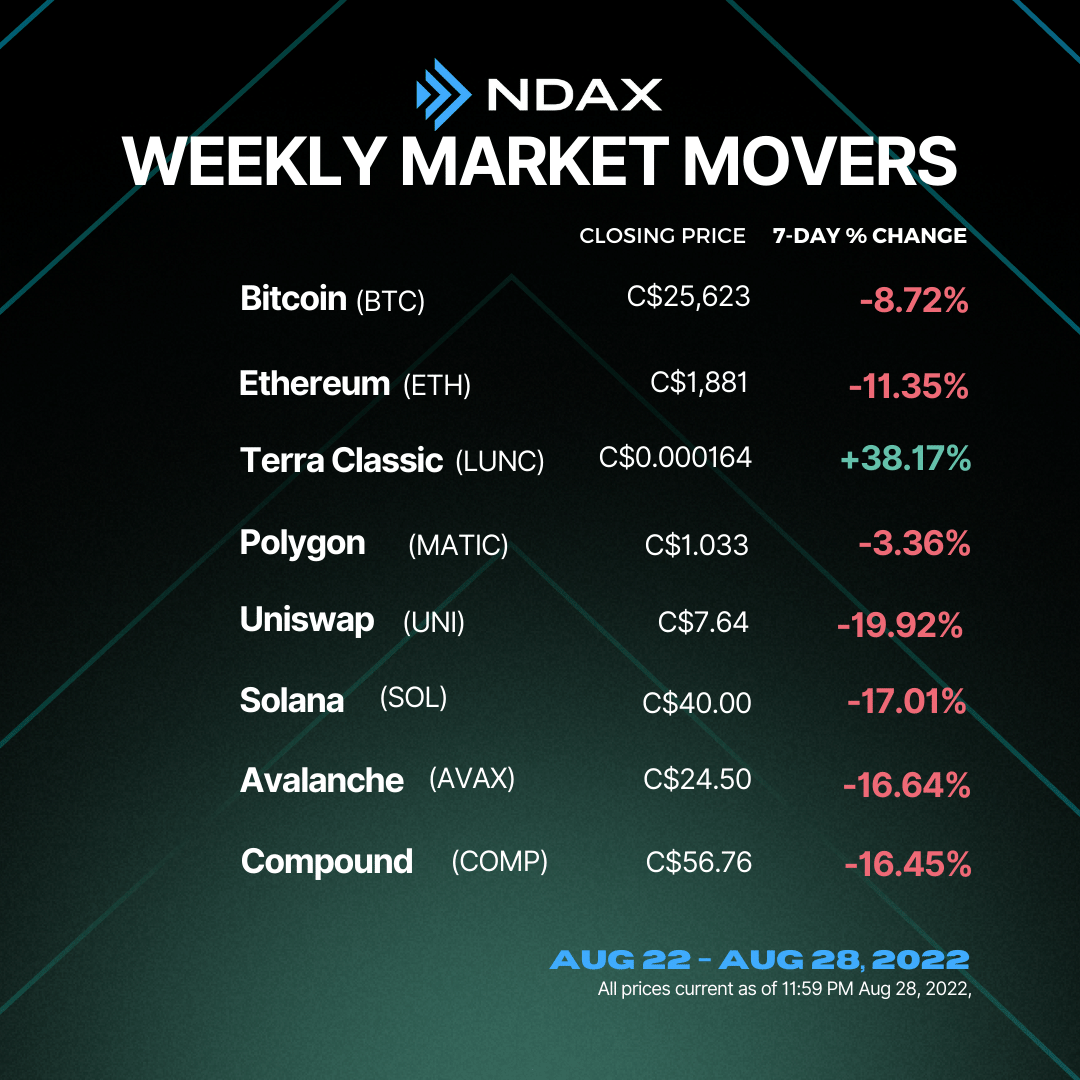

WEEKLY SNAPSHOT

BITCOIN TECHNICAL ANALYSIS

Bitcoin faced strong resistance around C$32,000 (50% Fibonacci Retracement Level) and witnessed a sharp correction. Prices fell almost by 20% from the recent high of C$32,229 to C$25,555. On a daily time frame, the asset was trading in an ‘Ascending Channel’ pattern; it resisted at the upper trendline of the channel and finally gave a breakout on the downside this weekend. Downsloping Moving Averages and RSI below 50 indicate the asset's bearish stance.

KEY LEVELS:

| Resistance 2 | C$32,000 |

| Resistance 1 | C$26,500 |

Ndax | BTC |

| Support 1 | C$23,000 |

| Support 2 | C$19,500 |

Disclaimer: This content is not intended to provide investment, legal, accounting, tax or any other advice and should not be relied on in that or any other regard. The information contained herein is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of cryptocurrencies or otherwise.