Weekly Crypto Market Report: April 11-17, 2022

BTC, ETH, COMP & More

Market Fundamentals Analysis

The week has been fairly range-bound for most assets, with not much action being seen on any side, indicating that the market is consolidating. Having said that, the overall sentiment is still bearish, as most assets seem to be stuck at their support levels.

With digital assets trading 15-65% off the lows of March, some participants are sidelined & behaving as though they’ve missed the rally. While it’s entirely justifiable to treat the current price set as a sort of no man’s land between dip-buying territory and [higher] take-profit levels, we think this trend has legs.

In markets with traditional supply & demand dynamics, it’s justifiably difficult to buy an asset that’s rallied 50% over the span of two weeks … but this is crypto after all, and momentum trading should be deeply ingrained in traders’ muscle memory. In the past decade of price action, interpreting the type of moves we’ve just seen as a sell signal would have resulted in missing out on some of the most spectacular rallies in the history of finance.

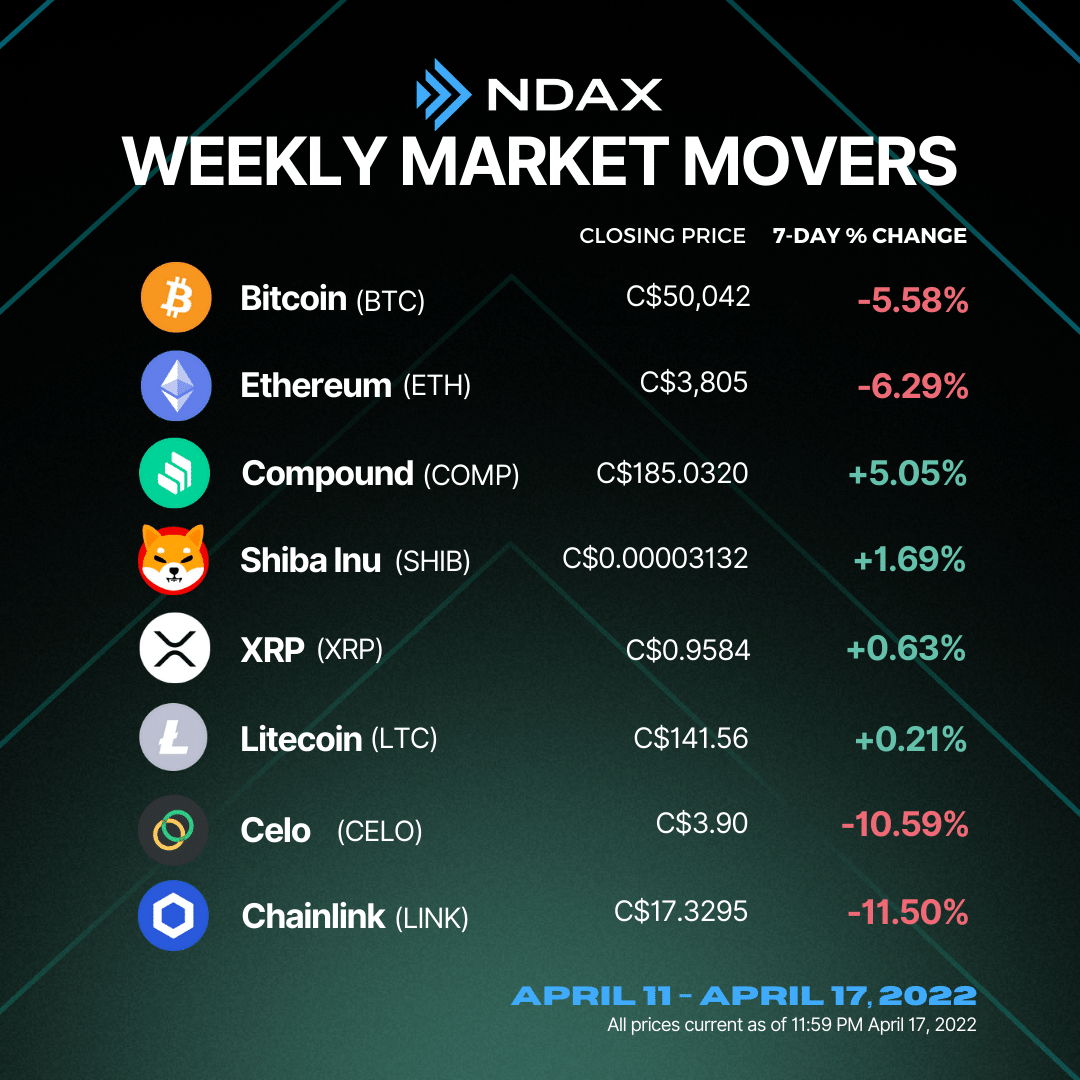

Technical charts are suggesting that Bitcoin, XRP, and Chainlink may be on the verge of a sharp breakout, but traders are unsure of the direction. Bitcoin and most major alts have been relatively quiet during the holiday period from Good Friday onward. This is probably due to the fact that U.S. equities markets are closed, during which time crypto traders are not making big bets. This may be what has resulted in a tight correlation between BTC and the S&P 500. The outlook is further dampened due to the uncertainty that persists in equity markets, over the past week. Most analysts are anticipating weakness in the short term, however, fundamentalists believe that Bitcoin could be in a consolidation phase with a large portion of its upside in the four-year halving cycle yet to come.

While both Bitcoin’s and Ethereum’s price action has been subdued in the past few days, some altcoins have witnessed some independent action. This suggests that the trend has become more coin-specific while the broader crypto market awaits an event that might trigger a market-wide move, up or down. Namely, we have seen LUNA, VET, LINK, and CELO take a beating, all down over 10% week-on-week. There seem to be no noteworthy gains that have ruffled the market.

The macroeconomic outlook hasn’t seen any upside ever since the Russia-Ukraine war started. With inflation and unemployment rising across both the US and China, the downward pressure on equities, and cryptos is high. Institutional flows have seen a dip, and retail investors seem to be sitting on the sidelines, due to the uncertainty currently prevailing in the market. BTC dominance has fallen and currently stands at 41.1%. This could be the start of the ‘altcoin season’, where alts rally and have a spillover effect on BTC. However, these rallies aren’t sustainable, and for the market to see a significant uptrend, a BTC-led rally must set in.

Weekly Snapshot

Market Updates

- Billionaire and Bitcoin advocate Ricardo Salinas believes that the growth of Bitcoin is inevitable, but its future depends on how fast and cheap transactions can get.

- Lawmakers in Australia want to regulate decentralized autonomous organizations (DAOs).

- President Biden announces former Ripple adviser as the pick for Fed vice chair for supervision.

- Fidelity Investments, one of the largest financial services firms with more than $11 trillion under administration, is launching exchange-traded funds (ETFs) focusing on the crypto ecosystem and the metaverse.

Bitcoin Technical Analysis

Bitcoin after making a ‘Spinning Top’ candle at the recent high of C$60,500 witnessed a sharp correction. The asset fell almost by 20% and has broken the uptrend line (Support) of the ‘Rising Channel’ pattern making a low of C$48,850. However, BTC has strong support at C$48,910.57 (61.8% Fibonacci Retracement Level). If it closes and sustains below the support, we can expect further downfall and the prices can slide to C437K to C$45K levels. If the bulls defend these levels, then we can expect a bounce and a relief rally. Downsloping 20-Day Moving Average and RSI in the negative territory indicating that bears have the upper hand.

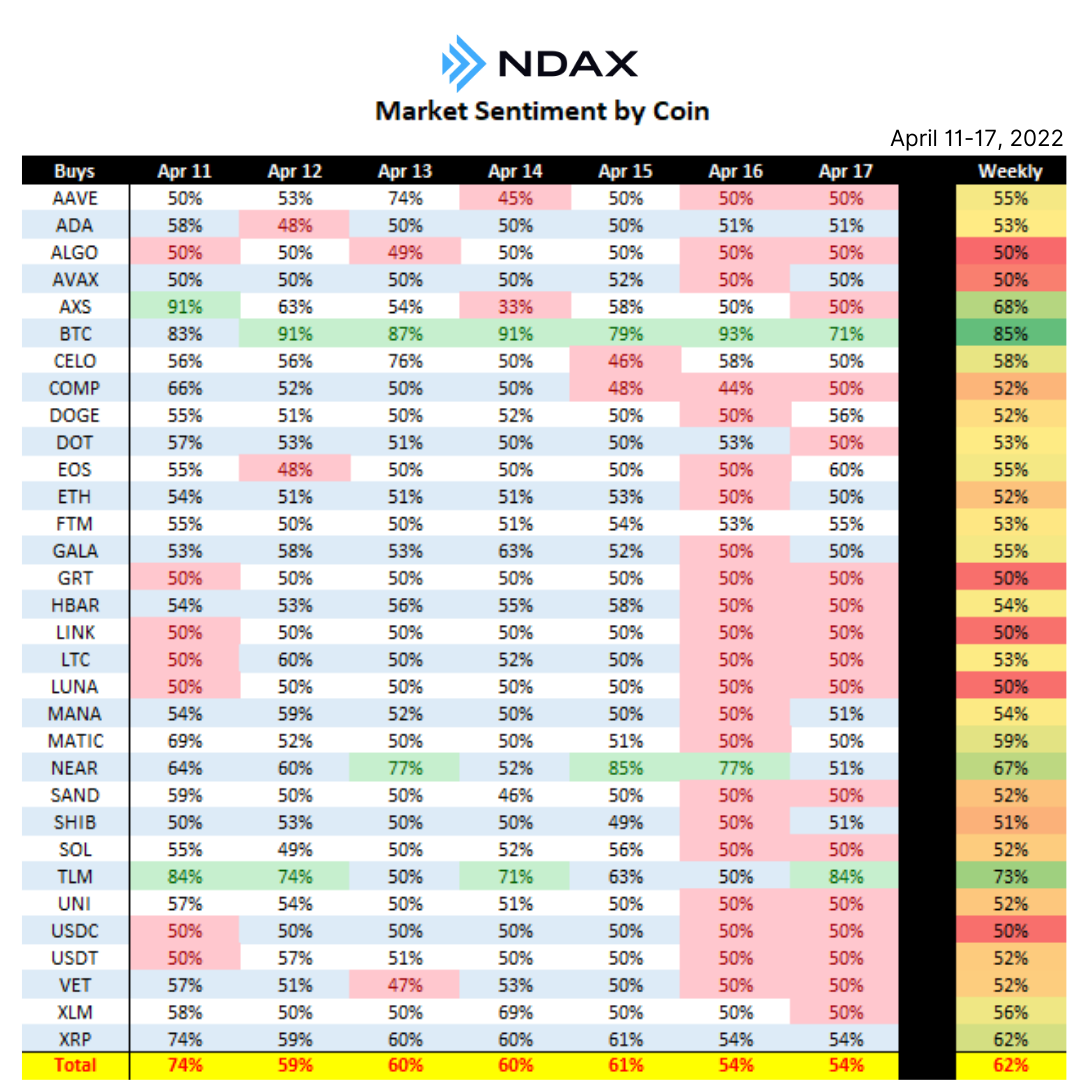

Weekly Sentiment by Coin

Perhaps unsurprisingly, Ndax users continued to buy dips. Canada’s favorite crypto trading platform saw a whopping 62% of this week’s transactions BOUGHT. Notable standouts include:

- Bitcoin sentiment is again very strong. 85% of orders are BUYS.

- Play2Earn–Axie Infinity (68%) & Alien Worlds (73%) of orders were LONG.

- NEAR Protocol (67%), Celo (58%), and XRP (62%) dips were bought as well LONG.

For the latest cryptocurrency prices, check out Ndax's Markets page.

Disclaimer: Information provided in the weekly market report is for information purposes only and should not be interpreted as investment, legal, or tax advice. Prior to investing, it is very important to evaluate your investment objectives and your risk tolerance carefully. This technical report is not meant to provide guarantees of future performance, and users should not rely on it, as the actual performance and financial results may differ significantly.