Weekly Crypto Market Report: April 25 - May 01, 2022

BTC, ETH, FTM & More

Market Fundamentals Analysis

While the market has sagged this week, it remains pretty headline-dense, both in and out of the crypto sphere. Most crypto assets are more or less unchanged on the week, with a few exceptions that will be highlighted below, and realized volume has picked up a bit, in the mid-50s now after trending at 40% for a bit last week. The price action at times this week has felt somewhat out of control of the crypto market, as correlations with equities are at a high, and equities have been moving. Earnings season is in full swing, and it’s not going as planned; after staging a recovery in March, equities are again approaching the lows set in the midst of the Russia-Ukraine conflict. Also in Europe, Russia halted gas supplies to Poland and Bulgaria, triggering fears that the war could spread beyond Ukraine.

Crypto-specific headlines remain generally positive. Central African Republic is set to adopt BTC as legal tender, becoming the first African nation to do so. Though a small country with a population under 5m, this does represent a key use case for Bitcoin; only 10% of the population has internet access, and almost none have banking access. USDD will be issued on May 5, potentially kicking off the next phase of Stable Wars. The market has considered the Anchor yield on UST to be basically a marketing spend, and it’s likely that Tron is considering the 30% yield on USDD in the same way. $APE has hit another all-time high of $27.60.This has been driven by the Otherside virtual land launch this Saturday, and the consensus is that it will feature a Dutch auction where folks can buy land.... but only with APE.

Amidst the decline in the crypto markets due to a hawkish Fed, the strongest-performing token is an animal-themed coin that can be used to buy virtual land. It is now the largest metaverse token, surpassing the likes of Decentraland's $MANA, The Sandbox's $SAND, and Axie Infinity's $AXS. In addition to that, we’ve been seeing heightened buy-side flow on several of the names mentioned above; APE has been almost exclusively buy-side, and we’ve seen buyers of SNX and CVX as well this week, as well as CRV. All these coins witnessed impressive retail and institutional inflows over the week. Ethereum passed another test this weekend, with a second successful shadow fork, a strong step toward the Merge.

Interestingly, FTM bears have successfully pressed through vital points to find fresher grounds to rest on. FTM lost nearly 80.5% of its value from its highs in January and hit an eight-month low on 1 May. Since then, however, the asset has seen a rapid rebound, up close to 20% in the past 24 hours, suggesting that accumulation on lows seems to be attracting buyers. Fantom's (FTM) technology continues to go mainstream, meaning more money is pumped into the innovative open-source platform, investors seem to be confident that over the longer term, the fundamental value added the Solidity protocol provides will yield high returns.

The overall sentiment in the marketplace hasn’t changed much. The macroeconomic situation, coupled with the Fed’s actions continues to keep investors cautious. Consolidation seems to be the flavor of the market right now, with no strong signs of any one-way movement.

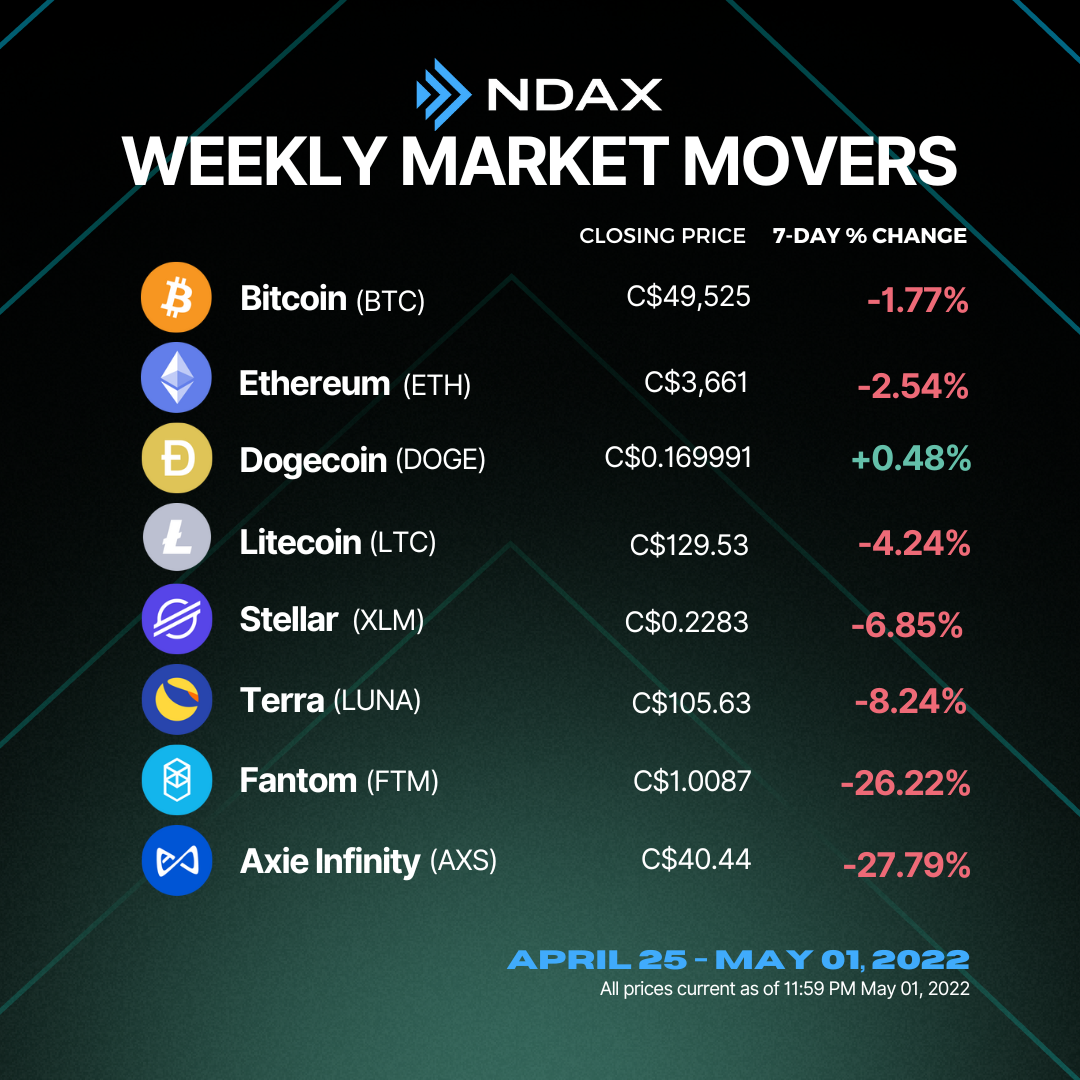

Weekly Snapshot

Market Updates

- Central African Republic is set to adopt BTC as a legal tender.

- Eurozone’s monetary authority, the Eurosystem, is looking to enlist financial companies willing to develop front-end solutions for the digital euro.

- The government of Uzbekistan has moved to expand its crypto regulations through a decree signed by President Shavkat Mirziyoyev.

- Shark Tank star Mark Cuban has come up with a way to solve Twitter’s spam problem using the meme cryptocurrency dogecoin (DOGE).

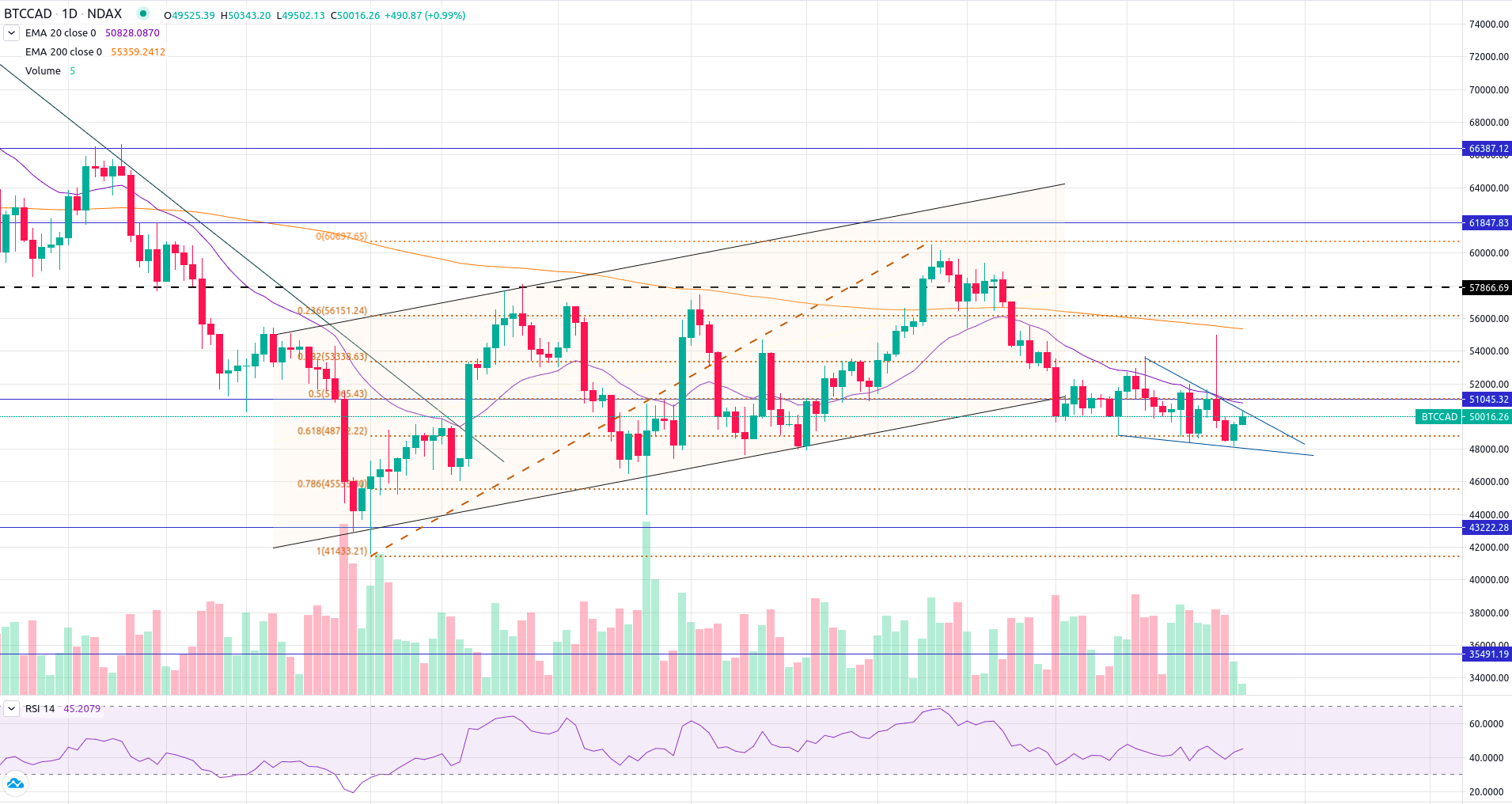

Bitcoin Technical Analysis

The weekends were choppy as Bitcoin witnessed the tough-of-war between bulls and bears as the prices fell on Saturday and recovered on Sunday. BTC slipped below C$48,792 (61.8% Fibonacci Retracement Level) and dropped to C$48,215. The asset has taken multiple support around C$48,000 in the past and this time too, it did exactly the same. Technically, on a daily chart, BTC is forming a falling wedge pattern. However, the RSI has formed a positive divergence. If the price closes and sustains above the resistance upper line of the wedge then we can expect it to surge up to C$51k to C$53k levels whereas a break or close below the support will lead to a further downfall and the prices can slide to C$47.5k - C$45.5k levels.

Key Levels:

For the latest cryptocurrency prices, check out Ndax's Markets page.

Disclaimer: Information provided in the weekly market report is for information purposes only and should not be interpreted as investment, legal, or tax advice. Prior to investing, it is very important to evaluate your investment objectives and your risk tolerance carefully. This technical report is not meant to provide guarantees of future performance, and users should not rely on it, as the actual performance and financial results may differ significantly.