Weekly Crypto Market Report: April 4 - 10, 2022

BTC, ETH, SOL & More

Market Fundamentals Analysis

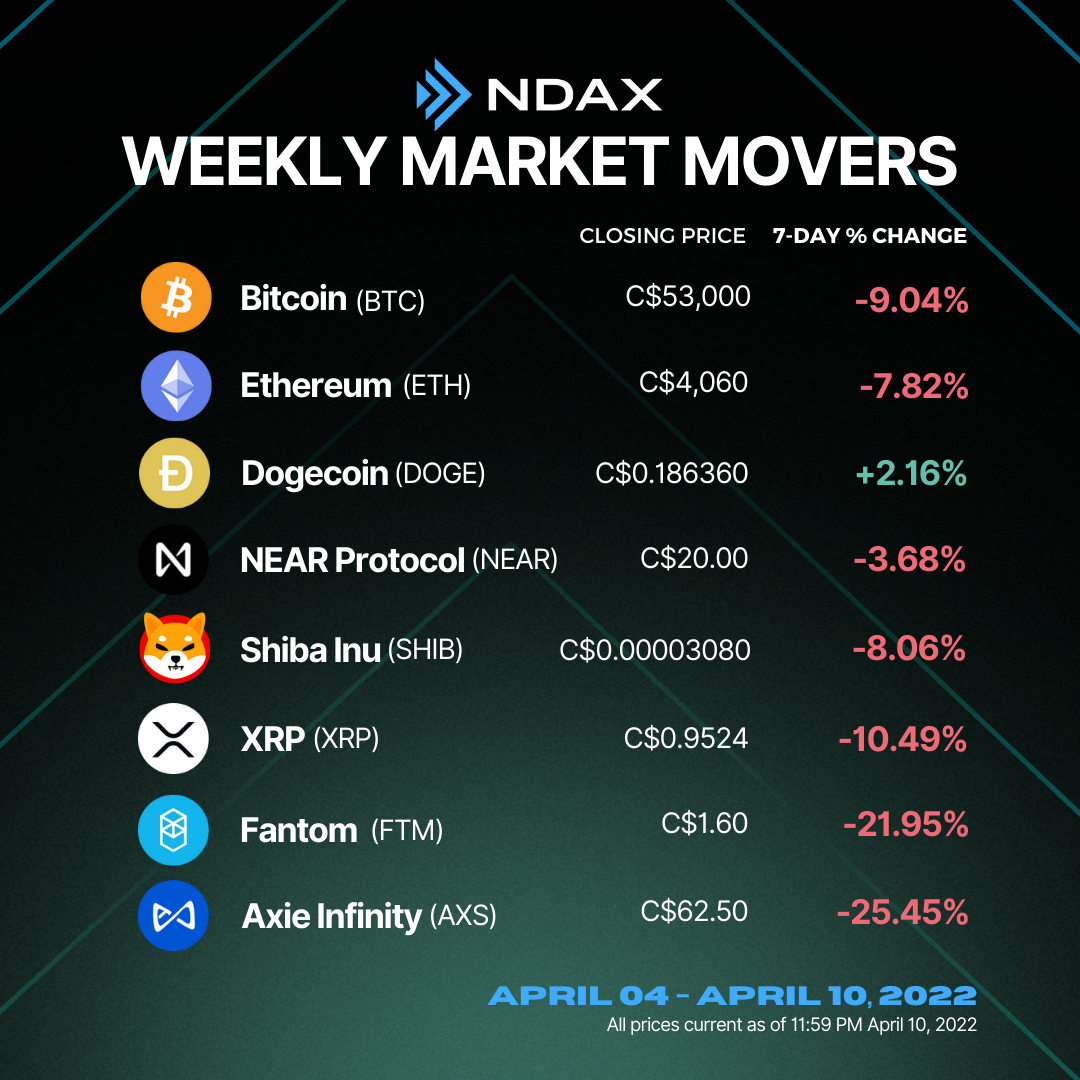

It’s been one week into April and the market continues to tread cautiously. BTC continues to remain choppy between C$52k and $58k in April and we have yet to significantly break in either direction, with the 20-day MA of C$55k and 200-day MA of C$56.5k remaining unbroken.

We saw BTC move lower to test the lower C$56k level last week, post which it hasn’t managed to recover. However, we are seeing market participants will be wary of being overly bearish on BTC, primarily due to the fact that the Luna Foundation Guard could resume its BTC buying any day. Generally speaking, typically, if altcoins start consistently outperforming BTC for a few weeks, it could precede a bull market.

BTC dominance is currently at 41.3%, and its market capitalization stands at $802b. ETH, on the other hand, has a dominance of 19.7%, and a market capitalization of $382b, at the time of writing.

There are several reasons why the market seems to have taken a bearish stance, over the past few days. Having said that, the widespread macro outlook seems to be changing, and zoning into positive territory.

- The dollar’s value is hurting under the weight of inflation.

- Countries and corporations continue to adopt crypto every day. Just last week, MicroStrategy announced that it acquired another 4,197 BTC. At current valuations, it is now holding $5.6b of BTC while the company’s market cap is $5.5b.

- The March FOMC could have potentially been a very damaging inflection point for risk assets, but crypto still managed to rally despite a hawkish projection from the Fed. Powell’s comments that the US economy was strong enough to withstand monetary tightening policies no doubt helped to quell risk-off sentiment as well.

- WW3 fears seem to have pulled back from March and unless we see a severe escalation of the Russia-Ukraine situation, we should remain supported.

Amongst the altcoins, Solana (SOL) price peaked at C$180.7 on April 2 after an 82% rally over a 20-day period. This positive performance can be attributed to recent NFT markets-related news and a market wide bounce, but the 22.7% decline since has investors confused.

Having said that, there isn’t too much happening in the alts space, as markets seem to be consolidating, and any gain is offset by profit booking amongst investors. Apart from SOL, DOGE and NEAR saw an impressive start to last week, but as the week progressed they too lost steam, and have seen a correction since.

Lastly, Bitcoin 2022 kicked off last week, 6th April. Some interesting rumors' that have been circulating include a potential update on the BTC bond from El Salvador, Jack Dorsey’s plans for a fiat-BTC DEX and even Apple possibly announcing support for BTC payments.

The overall sentiment is towards the bearish side. Notwithstanding, the fundamental outlook remains strong. The market lies at its crucial support levels, across multiple assets, and a rebound from here is likely to lead to a rally. However, we believe for the rally to be a successful one, it must be led by BTC, instilling better investor confidence in the longer run.

Weekly Snapshot

Market Updates

- Following the announced integration of the payment app Strike with e-commerce platform Shopify to accept Bitcoin (BTC) through the Lightning Network, the crypto community raised concerns over the legal implications of the move.

- The Russian Prime Minister declared that the cryptocurrency holdings of Russians are worth billions of dollars but the government is yet to adopt a regulatory framework for the industry.

- Vitalik Buterin quietly donated $5M ETH to aid Ukraine as total tracked crypto donations reach $133M.

- The National Bank of Georgia is taking steps to regulate the crypto market in the Southern Caucasus country, its governor revealed in a recent interview.

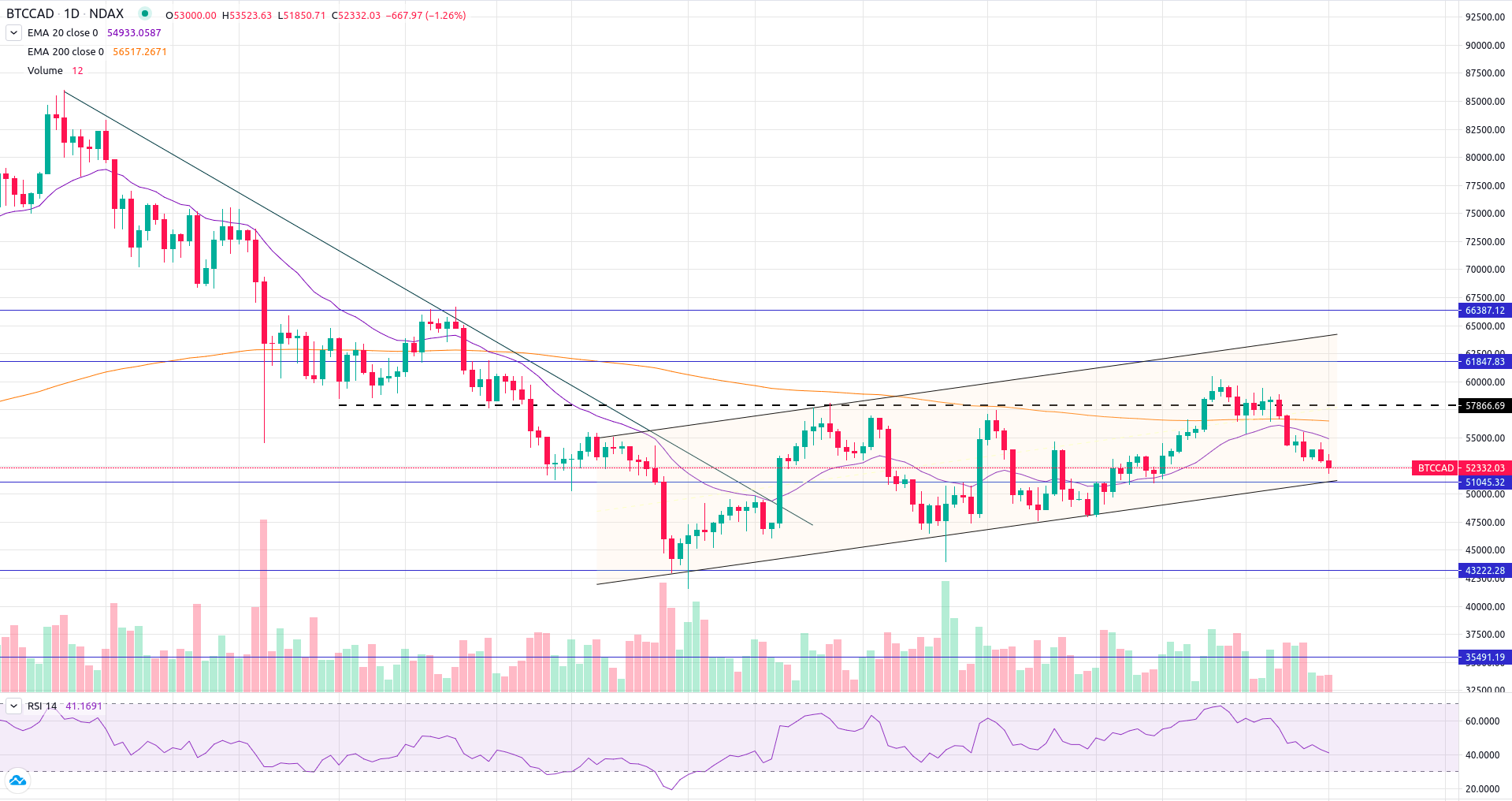

Bitcoin Technical Analysis

Bitcoin, after breaking the long-held resistance of C$57,500, made the high of C$60,500. The asset made a ‘Spinning Top’ candle in an uptrend which indicated indecisiveness on the part of bulls to continue its juggernaut for the moment and witnessed profit booking. The asset corrected almost by 14.3% making the low of C$51,850.

Technically, on a daily time frame, BTC is still trading in a ‘Rising Channel’ and has a very strong support zone from C$51,500 to C$51,000 and we expect to see a bounce from these levels whereas C$55,500 and C$59,500 will act as strong resistance.

Key Levels:

Weekly Sentiment by Coin

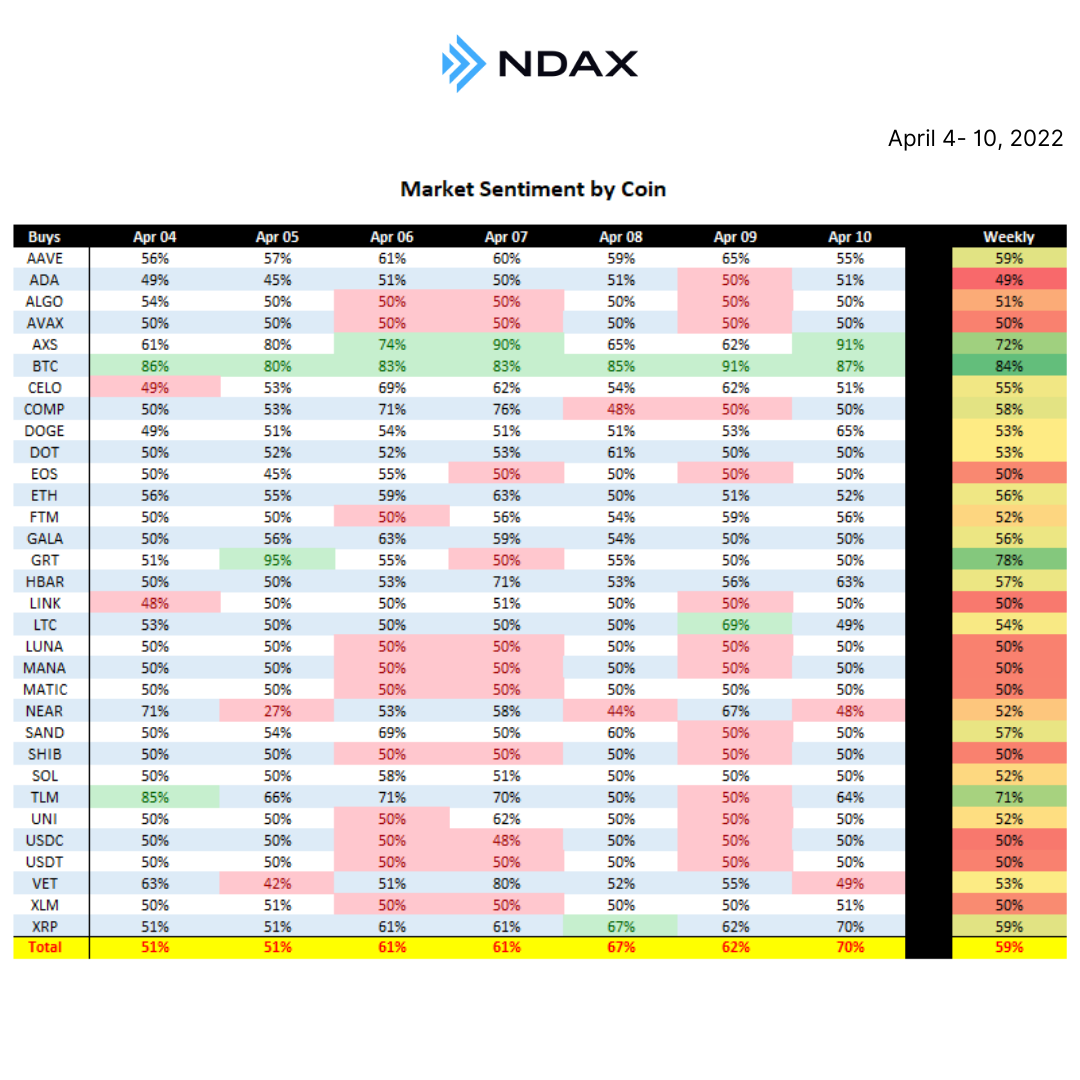

Ndax users bought the dip. All of them.

Here’s what’s happening on Canada’s favorite Crypto Trading Platform:

Notable standouts include BTC sentiment outperforming week-over-week-over-week with 84% of orders being buys. Alien Worlds, The Graph, and Axie Infinity were long, ranging from 71-78%, while Ethereum, Compound, and Aaave floated in the high 50%s.

For the latest cryptocurrency prices, check out Ndax's Markets page.

Disclaimer:

Information provided in the weekly market report is for information purposes only and should not be interpreted as investment, legal, or tax advice. Prior to investing, it is very important to evaluate your investment objectives and your risk tolerance carefully. This technical report is not meant to provide guarantees of future performance, and users should not rely on it, as the actual performance and financial results may differ significantly.