Weekly Crypto Market Report: Jun 06- Jun 12, 2022

BTC, ETH & More

Market Fundamentals Analysis

Extremely soft macro tone weighing down on global risk sentiment after a stronger than expected inflation print on Friday. We look forward to Wednesday’s upcoming FOMC meeting where the Fed is widely expected to hike 50bps with risks skewed hawkishly. Crypto itself also took a leg lower, with ETH and Alts underperforming the BTC decline. Special attention remains on the StETH:ETH ratio in the CRV pool as StETH continues to trade at a discount to ETH. Ratio is currently 0.96.

ETH continued to be weak vs BTC in the past month, dropping from 0.076 to 0.058 (ca 24% down since May 10th). The Merge will stay as the core narrative for any significant shifts in the fundamentals. The market is currently expecting the Merge to take place somewhere in Sep. or Oct. at earliest. ETH is supposed to stay more volatile than BTC in the coming months due to the Merge. If the Merge is further delayed, ETH weakness could deteriorate. Should the Merge be completed as expected, ETH/BTC could revisit 0.08 level or higher.

BTC and several altcoins are fluctuating at their critical support levels, and June 10’s higher-than-expected CPI report isn’t helping. US equities markets plunged on June 10 after the Consumer Price Index (CPI) report showed inflation at a staggering 8.6% from a year ago, the highest increase since 1981. Much of the data indicates that talks of inflation having peaked were premature. As per Bloomberg, investors are pricing in the key interest rate of above 3% by this year end.

Activity continues to remain range bound with some select buying sub C$35k seen while miners continue to be selling into strength. Derivs flow has been led largely by the flattening of call skew along with some compression of the BTC/ETH skew. Call overwrites continue to remain a theme as we continue ranging. Flows wise, we began to see miners actively returning to sell as the price moved after taking a pause yesterday. While there were programmatic buys observed through the whole of late last week, selling outweighed such flows during the Asia hours (T-1) and it will be interesting to see how the bears react to the upward move overnight during the Asia session today.

Spot continues to trade actively with a continuation of ETH/Alt weakness vs BTC strength. Activity in both BTC and ALTs remains elevated, with flow slightly skewed towards selling as we continue to look for trends. Focus in derivatives continues to remain mainly in BTC mixed with some alt interest in SOL and AVAX. Lending continues to remain two way with greater interest from clients to lend cash.

Overall, the market seems to be in a consolidatory phase. The bears seem to be in control, and the unfavourable macroeconomic conditions are not helping. BTC dominance is at 47% while ETh dominance is around 16%. The total crypto market cap has hit a low of $1 trillion, at the time of writing. Institutional and retail flows have significantly reduced, indicating that traders and investors remain cautious, awaiting a strong signal as to where the market might move here.

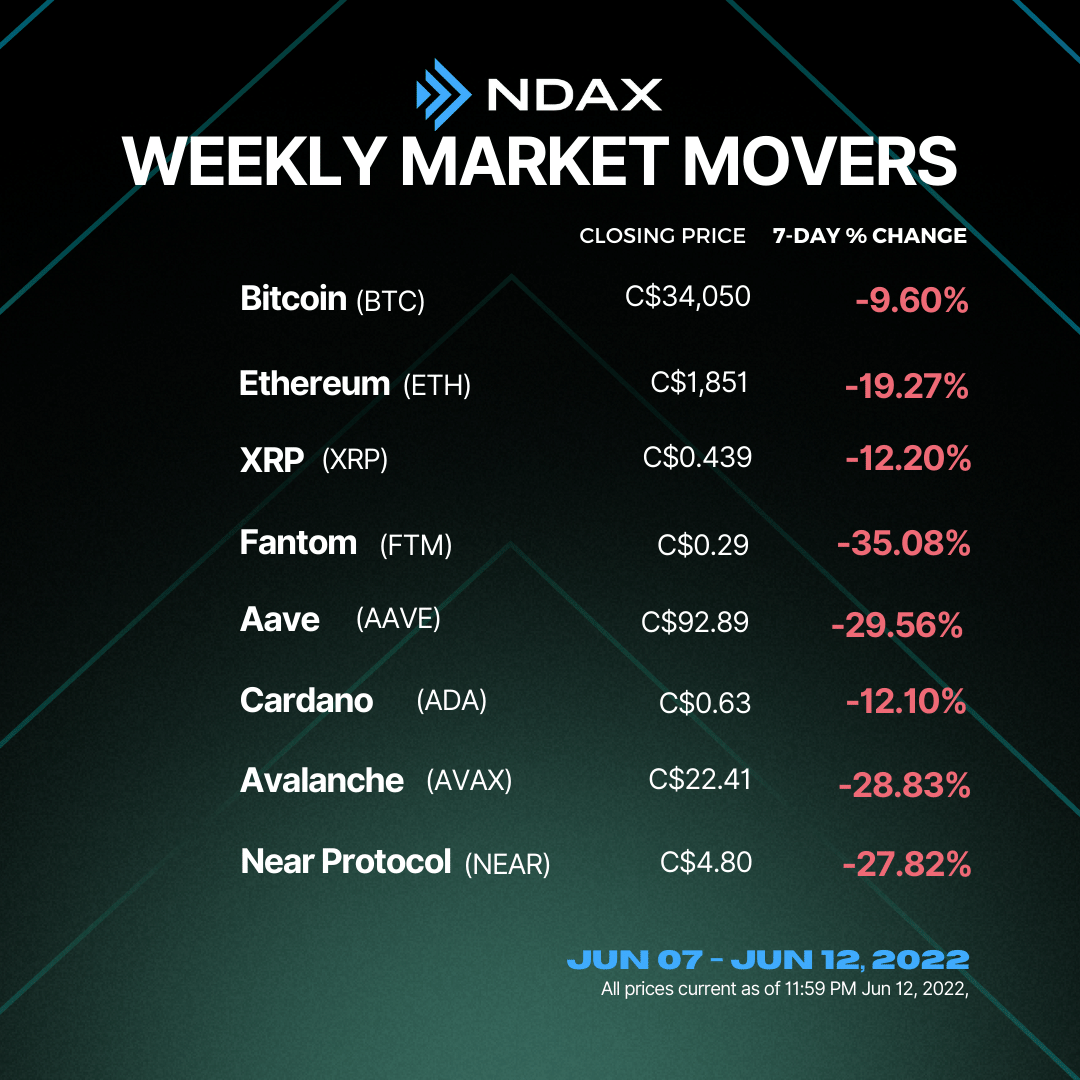

Weekly Snapshot

Market Updates

- Do Kwon, the CEO and co-founder of the infamous Terra (LUNA) and TerraUSD (UST) ecosystems, refuted the claims of cashing out $80 million every month for nearly three years.

- The lawsuit against Gemini is not about an exchange-traded fund, it’s about how a particular Bitcoin futures contract is being represented.

- Swedish central bankers snipe Bitcoin mining citing rampant energy use.

- Lithuania aims to tighten crypto regulation and ban anonymous accounts

- Halfway through 2022, the BTC ATM installation numbers dropped 89.75% by May, followed by a swift recovery in June.

Bitcoin Technical Analysis

BITCOIN was trading sideways in a range between C$35,500 to C$40,500. The asset finally gave a breakout on the downside of the range yesterday and witnessed a sharp fall making the lowest weekly candle since December 2020. On a daily time frame, BTC has broken and closed below the long-held key support of C$35,000 and made a low of C$30,196. The asset is trying to take support at the psychological level of $30k. If it holds and sustains above the support then we can expect some upward movement whereas a break below C$30k will lead to further downfall and the prices can slide to C$27.5k levels. Downsloping Moving Averages and RSI in the negative territory indicates that bears have the upper hand.

KEY LEVELS: