Weekly Crypto Market Report: March 14-20, 2022

BTC, ETH, AAVE, AVAX & More

Market Fundamentals Analysis

This was a relatively quiet weekend. This is coming on the back of an FOMC meeting last week which came in “as expected” (25 basis points hike, hawkish language) and generally improved the chance for peace in Ukraine. You could make the argument that the process here has not improved much, but equities rallied pretty significantly through the latter part of last week.

Unlike several of the spikes higher in BTC of the past month, BTC’s rally on Friday appears to be an old-fashioned equities-correlation rally. While BTC sold off slightly on Sunday, S&P futures are opening close to unchanged this morning. Signs of potential changes to US foreign policy stances to other oil producers like Iran and Venezuela over the weekend should indicate just how incredibly deep the political anxiety is over $4.00 gasoline.

In the latter part of last week, US equities responded surprisingly well to the Fed meeting, with stocks trading almost to the March highs. This likely has as much to do with Chinese equities, which came out of their free-fall too, when China’s State Council pledged to support stability.

At the same time, commodities have generally come back down to March 1, 2022 levels, with crude back under $100 and Gold back around $1900.

BTC has reacted well, seeing a constructive rally over the past 48 hours. We have seen sharp rallies in BTC three times in the past three weeks, and they have been retracing faster each time. The February 28 rally took 3 days to retrace; the March 8 rally took a day; last week’s took about an hour. Each of these were sharp, sudden rallies, and difficult to maintain. The rally of the past few days has been longer and steadier and feels more driven by equities than a single outsized buyer.

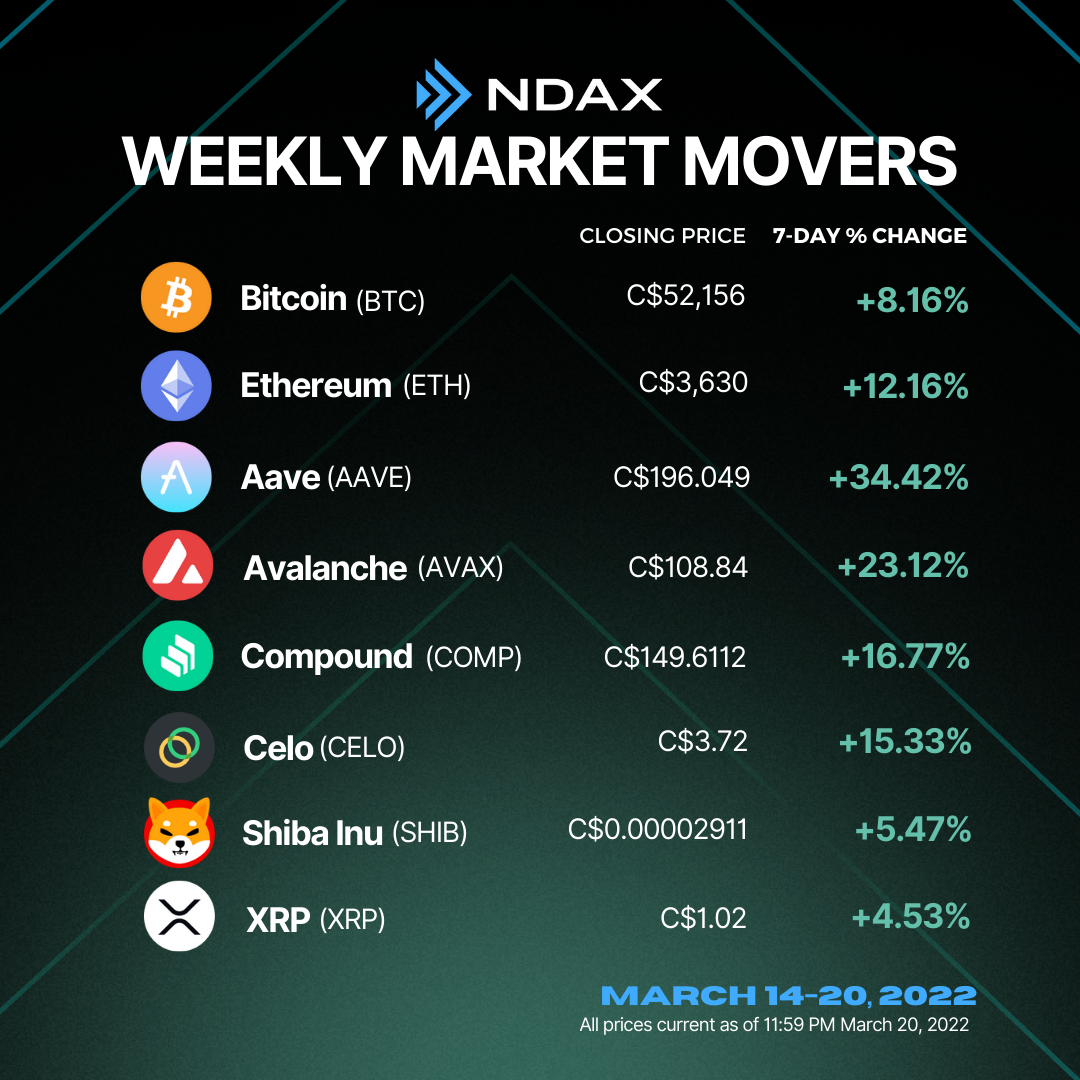

When it comes to alts, we’re back in a high-correlation market within crypto. BTC is up about 8% on the week, with most alts in the 10-15% range. ETH/BTC has been scraping along with its 0.065 support level for the past week, and is now back to the top of its recent range, above 0.068. Breaking through the March high of 0.07 could trigger some excitement in both ETH and alts in general. The market generally seems to be sleeping on the Merge, which could be coming as soon as June, though we think it’s more likely to occur in July.

AAVE has seen upwards of a 30% spike over the week, after its V3 introduction. V3 will enable the protocol to generate more yield for liquidity providers, and provide better security to its users. The release turned RSI into the positive zone, and bulls were seen accumulating the asset.

AVAX continued to impress over the week, up by more than 20%. AVAX has a very huge utility as it is lighting fast, cheap, and very scalable through its subnet technology, which is why the protocol has seen a surge in developers coming on board. RSI remains positive, and if the asset crosses the C$105 resistance level, another rally might kick in.

While we haven’t seen any major losers this week, major alts have been pretty range-bound, indicating that the market might be consolidating.

The broader macroeconomic fear/disarray is an opportunity to gently scale into risky assets at attractive prices. The overall sentiment isn’t necessarily bearish, but more of caution. Traders are buying the dips, hence markets continue to be in a consolidatory phase. Given the macroeconomic uncertainty, this is not a bad thing, but in fact a sign of maturity, and confidence among long-term investors.

Weekly Snapshot

Market Updates

- Layer 2 scaling solution Optimism, has secured $150M in funding which it will use to hire new developers and decrease fees on the Ethereum network.

- ApeCoin announcement surges BAYC floor price to near-ATH before correction.

- EU Regulators warn crypto is unsuitable as an investment or means of payment for most retail consumers.

- President Volodymyr Zelenskyy has signed the law “On Virtual Assets” which aims to regulate the crypto market in Ukraine.

- Terra founder hints at $3 billion BTC purchase, explains new Bitcoin-linked tokenomics.

- Canadian top bank CIBC to utilize Ripple's cross-border payment solution.

Bitcoin Technical Analysis

Bitcoin, on a daily time frame, continues to trade in a ‘Rising Channel’ but the bulls yet again failed to breach the C$54,000 level. However, the prices are taking support at the psychological level of C$50,00 and are currently hovering around the 20-day Moving Average.

The asset has a strong resistance at C$58,500. Once BTC gives a breakout above C$58,500 with good volumes then we can expect the prices to further surge up to C$65k levels whereas C$47,000 will act as strong support and a break below this support will lead to further downfall and the prices can test the key levels from C$43,000. Declining volumes, flat Moving Averages, and an RSI around 50 indicate a neutral stance for the asset.

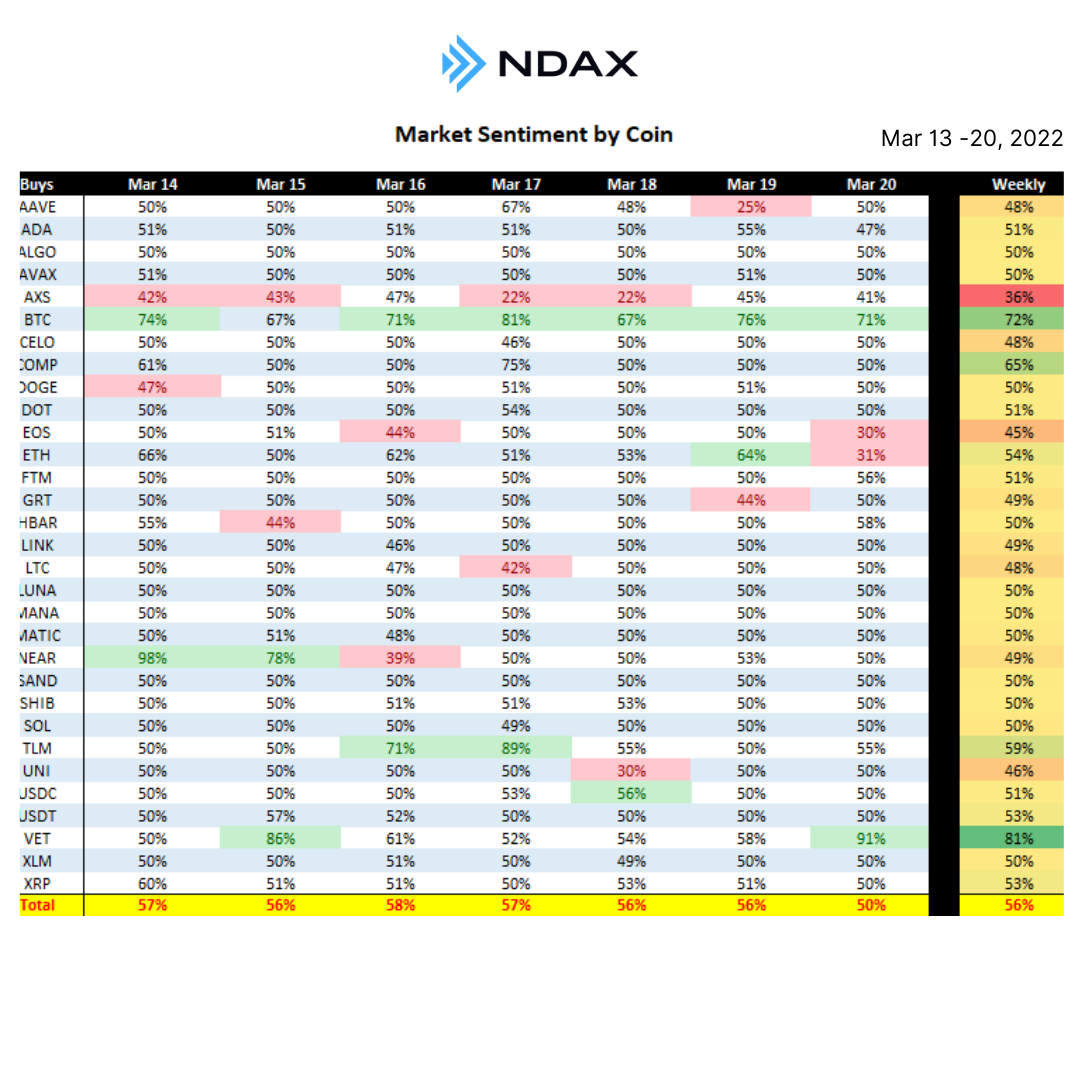

Weekly Sentiment by Coin

This past week on Ndax saw positive sentiment for VET (81%), BTC (72%), COMP (65%), and TLM (59%) as these assets saw their trades being buy orders.

Overall, most coins hovered again this week around the 50/50 zone, however, AXS (36%) had a strong sentiment towards being sell orders.

For the latest cryptocurrency prices, check out Ndax's Markets page.

Disclaimer: Information provided in the weekly market report is for information purposes only and should not be interpreted as investment, legal, or tax advice. Prior to investing, it is very important to evaluate your investment objectives and your risk tolerance carefully. This technical report is not meant to provide guarantees of future performance, and users should not rely on it, as the actual performance and financial results may differ significantly.