Weekly Crypto Market Report: March 21 - 27, 2022

BTC, ETH, VET & More

Market Fundamentals Analysis

Towards the end of this weekend, BTC managed to trade through its C$58k resistance, off of which it bounced in February and March. There are a few crypto-specific narratives that have helped to push this rally, but at the end of the day, it feels as if the easing of intensity on the macro side has allowed BTC to pull out of its equity-driven weakness from Q1. The focus on Ukraine-Russia has diminished, with de-escalation seeming as likely as escalation at this point. On the rates side, the market seems to have digested the likely path of FOMC and has come out with acceptance.

The main crypto story over the past week has been the persistent purchases of BTC by the Luna Foundation. As of now, the address associated with LFG has accumulated roughly 25k BTC, and frankly, this buying does matter. It matters in its own right and it also helps to contextualize the potential state of BTC a few years from now, when it’s much more common for treasuries to accumulate BTC.

The other primary narrative at the moment driving some confidence in this rally is the impending Merge on Ethereum. Sometime over the past few weeks, this has shifted from something that people weren’t discussing much to “The Merge is the new Halvening”. The narrative certainly seems to be there. However, this doesn’t actually seem to be driving idiosyncratic ETH buying; ETHBTC has not broken out in a meaningful way, nor has ETH broken away from other L1s (in March, ETH is up 25%, more than SOL or AVAX, 18%, but less than NEAR, 53%, DOT and ADA, 33%, and LUNA, 27%).

BTC and most major altcoins could witness a minor dip to retest lower support levels, if the market does not sustain, and close above these levels. But given that the rally has come with good volume support, the overall trajectory appears to now favor bulls.

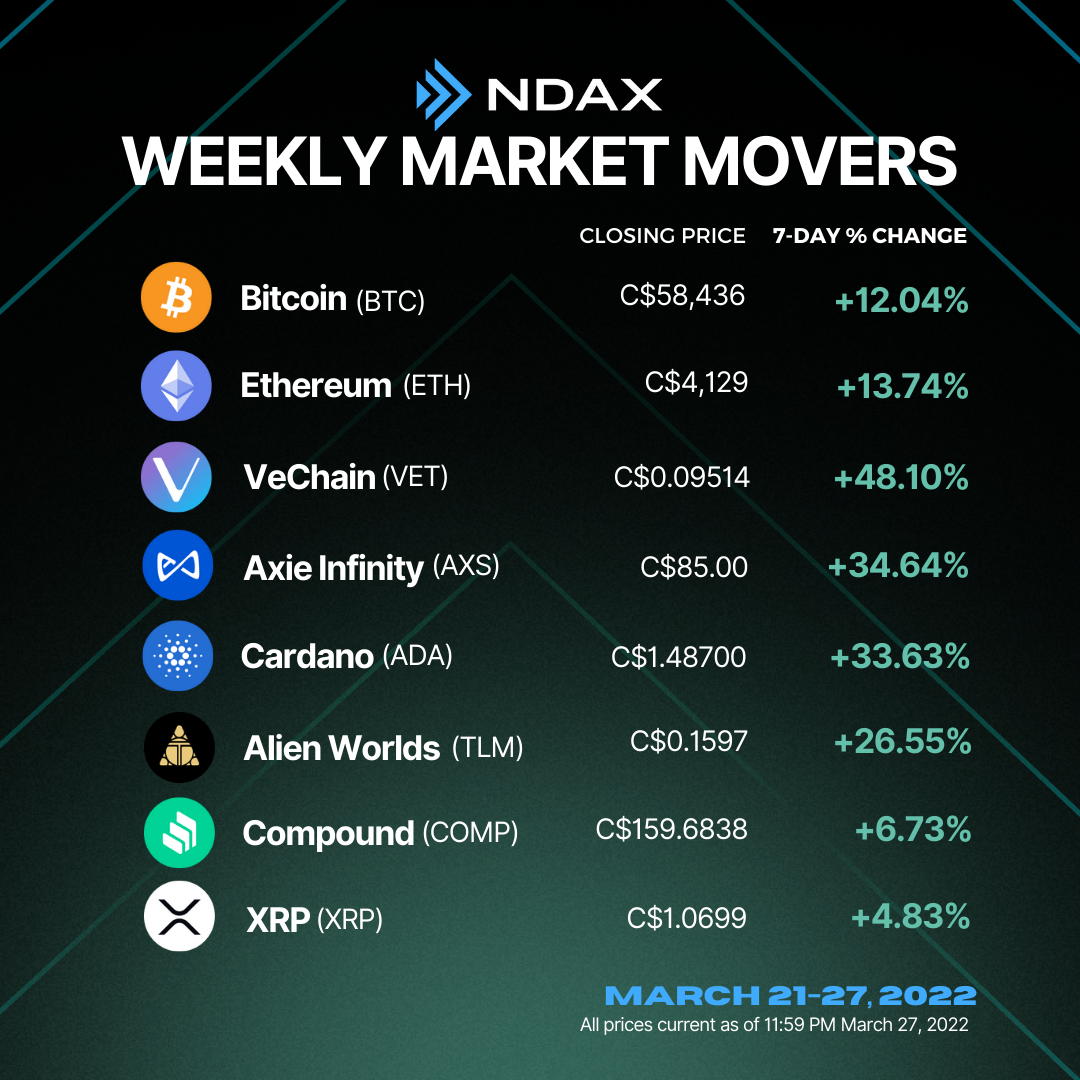

Several alts have shown a strong rally this week. Leading the pack is VET, which witnessed a surge after Haun announced that the fund has raised $1.5 billion to invest in Web3 startups. VeChain has been moving sideways in the past few weeks, with more downside action than larger cryptocurrencies, and this week that tide finally turned, backed by a strong fundamental development. While most alts have seen a rally, AXS, ADA and TLM stand out.

Overall, the week has been a positive one for the ecosystem. After a prolonged period of range-bound activity, where the market seems to be consolidating, we have seen a one-way push. How long this rally sustains remains to be seen, but volumes across retail and institutional clients remain promising. For the market to set a new stable underlying level, volumes are crucial. As of now, we haven’t seen any major profit booking taking place, suggesting the formation of a sustainable rally, and good investor confidence.

Lastly, we must remain cautious given the broader macroeconomic fear/disarray. While the sentiment seems to have turned bullish, we do anticipate some degree of volatility to persist.

Weekly Snapshot

Market Updates

- The City of Austin gears up to become America’s next crypto hot spot by passing two resolutions focused on cryptocurrency and blockchain innovation.

- Rio de Janeiro will officially start accepting Bitcoin payments for taxes related to urban real estate within their city limits.

- Bank of Ghana (BOG) outlines some of its key reasons for developing its central bank digital currency (CBDC).

- Lok Sabha, India’s lower house of parliament, passed Finance Bill 2022 Friday which includes a proposal to tax crypto income at 30% and impose a 1% tax deducted at source (TDS) on every crypto transaction.

Bitcoin Technical Analysis

Bitcoin, after taking multiple support at the rising up trendline, is showing good strength and the prices are in green for the seventh consecutive day. The asset was facing strong resistance at C$58,000. However, The bulls have managed to beat the key level and the prices are trading above the horizontal trendline and the 200 Day Moving Average.

If BTC sustains and closes above C$58,000 then we can expect the prices to further rally up to C$65,000 to C$66,500. The rising Moving Average and RSI at 68 indicate a good and positive sign for the asset.

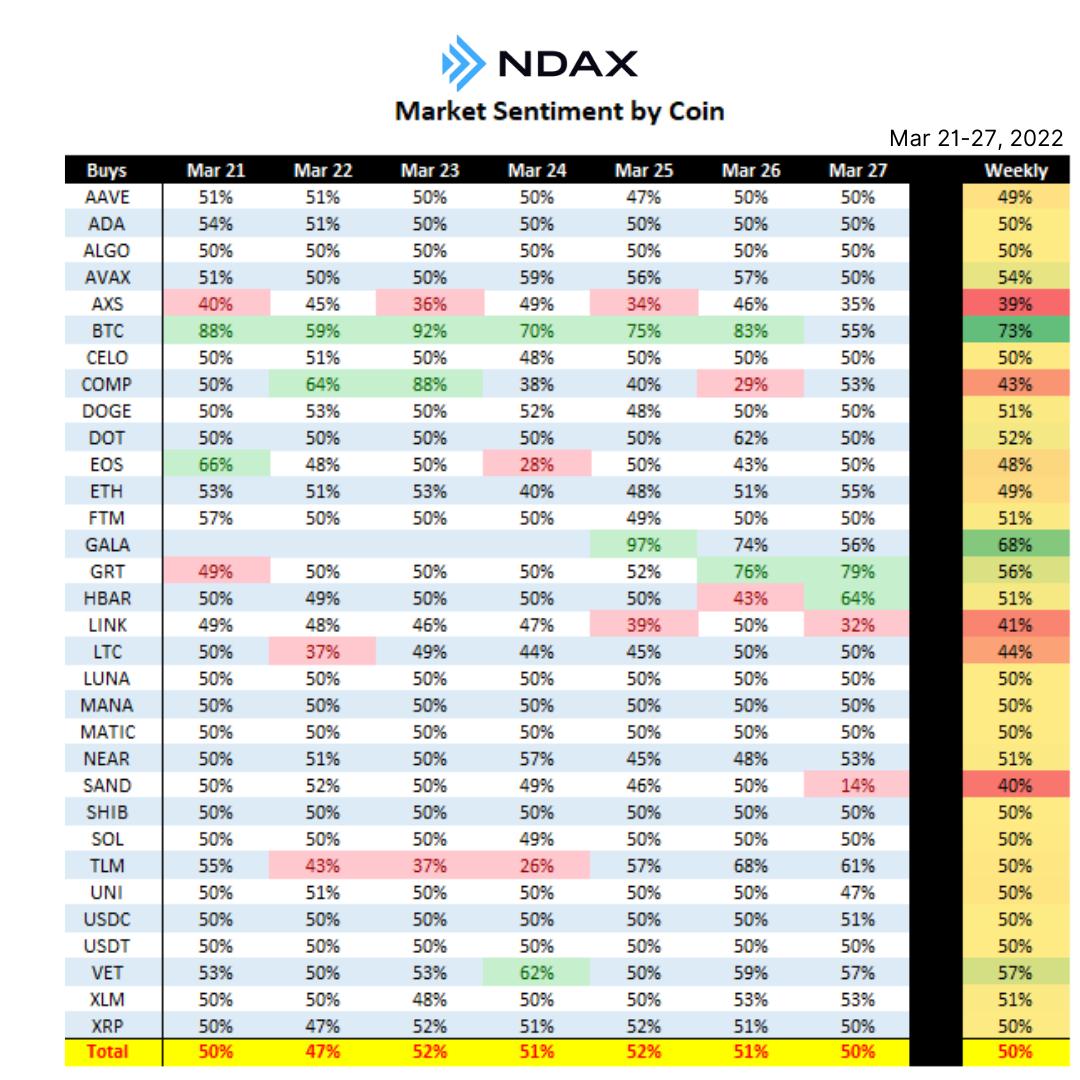

Weekly Sentiment by Coin

This week, most coins hovered again this week around the 50/50 zone. however, Bitcoin sentiment outperforms handily again this week with 73% being buy orders. The new coin listing of GALA (Gaming), marked a starting market sentiment for Ndaxers at 68% being buy orders. On the flip side COMP, LINK, LTC, and SAND were short at 56-60% (sell orders).

For the latest cryptocurrency prices, check out Ndax's Markets page.

Disclaimer: Information provided in the weekly market report is for information purposes only and should not be interpreted as investment, legal, or tax advice. Prior to investing, it is very important to evaluate your investment objectives and your risk tolerance carefully. This technical report is not meant to provide guarantees of future performance, and users should not rely on it, as the actual performance and financial results may differ significantly.