Weekly Crypto Market Report: May 23-29, 2022

BTC, ETH & More

Market Fundamentals Analysis

After a thankfully quiet weekend, the crypto market seems poised to reassess its standing. Since the chaos of the week of May 9th, BTC has felt more exciting than it actually is, trading with a 50% realized vol for the past week, while never actually feeling that stable. For one thing, the price has lingered at the edge of a cliff, touching C$37,000 five times a week, which is the low outside of the height of the LUNA crash. For another, alts have traded much weaker than BTC across the board.

The main market event last week was a massive sell order at Binance which sent ETH from C$2,500 to C$2,200 in a quick afternoon session; ETH/BTC has really not recovered since then. Ahead of The Merge, ETH has been the consensus trade (and frankly, remains so), and it’s reasonable to expect continued volatility on ETH. Realized vol over the past week on ETH was around 90%, and implied is around 85%, compared to 70% on BTC. The ratio of 9:5 on ETH: BTC realized vol is on the high side and seems difficult to sustain, compared to historical, but nonetheless, ETH implied vol feels cheap compared to BTC, at a 1.2 ratio.

The market has both tailwinds and headwinds, resulting in choppy water (bad sailing metaphor). In terms of tailwinds, the most encouraging sign is the rally we saw in equity markets last week. So far this year, the high correlation between equities and crypto has been strong and consistent. Now, that’s mostly been on the downside, and we’ve seen in the past that crypto is, unfortunately, a bit slower to track equities on risk-ON moves. Based purely on equities, the path of least resistance for crypto does seem to be up.

With that said, there are other types of resistance. The selloff of May 9th left many funds with deer-in-the-headlights syndrome, and a rally here would face some layered relief sell orders. Additionally, the calendar is probably not the market’s friend, with the first of the month coming on Wednesday. Normally, the first is slightly bullish, with subscription flow giving the market a little bit of a push. This month, however, is likely to be more of the other thing, with redemptions almost inevitable.

Month-end rebalancing flows driving equities to the best week since Nov 2020, with Asia also opening firmer this morning. Price action in crypto continues to consolidate just under C$40k for BTC and around $2.5k for ETH as we closed the week red. The US is out for Memorial Day today. Spot saw ETH merge trades unwound on Friday and rotation of alts into BTC with volumes picking up. Derivs activity was largely focused on rolls into Friday’s expiry. We still continue to see derisked accounts hedging right tail risk across. Luna 2.0 went live over the weekend. Treasury management continues to be thematic within the lending space with good two-way activity seen.

The market at large, continues to be in a consolidatory phase, as it has been over the past few weeks. It is difficult to say which way the market will head, given that larger macroeconomic factors are at play, and investor confidence is in the balance. Having said that, the next few weeks remain crucial, and a BTC-led rally is much needed to support markets, and drive a market-wide recovery.

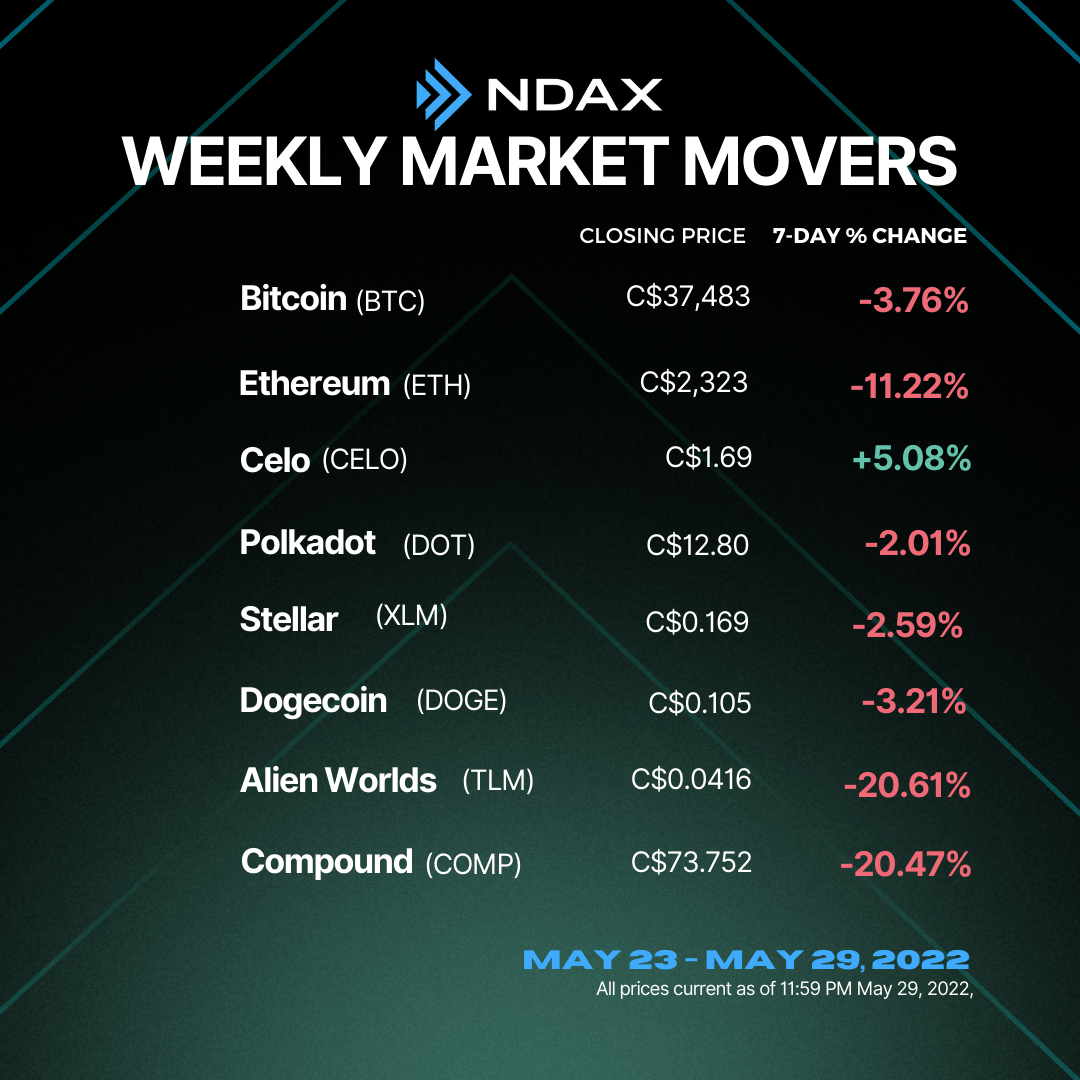

Weekly Snapshot

Market Updates

- After Tesla, Elon Musk announced his plan to extend the payment option for his space exploration company, SpaceX.

- The Terra 2.0 mainnet (Phoenix-1) went live on 28th May as per the original timeline set by Terra developers and started producing blocks.

- The past week in DeFi saw Uniswap breach $1 trillion trading volume, while WEF 2022 saw Terra at the center of most crypto and DeFi discussions.

- Halfway through 2022, at the proof-of-concept stage, RBI is in the process of verifying the feasibility and functionality of launching a CBDC.

Bitcoin Technical Analysis

BITCOIN has traded in red for the past Nine weeks in a row, for the first time in history. However, after making the ‘Long Legged Doji’ candle at the recent bottom of C$33,095, the asset is trading sideways and consolidating in a range between C$36,500 to C$40,500. BTC has taken multiple support around C$35,000 in the past and this time too, we can see that it is not giving the daily closing below the support indicating buying at lower levels. Once the breakout occurs above C$40,500 with good volumes then we can expect a rally up to C$42k to C$44k whereas a close below C$36,500 will lead to further downfall and the prices can test C$33k levels. On a daily time frame, we can see a positive divergence on RSI indicating that the bearish momentum could be weakening.

Key Levels: