Monday Market Report | Jul 25 to Jul 31, 2022

BIG PICTURE

This will come as a surprise to few; there has been a distinct mood shift in markets following last week’s 0.75% rate hike by the Fed. But all anyone seems to want to talk about is 1) Are we in a recession (what’s in a name?) and 2) Is this a sucker’s rally, or does this ‘dead cat’ have legs? (who knows).

While things may feel distinctly less gloomy than they did a month ago (The Fear and Greed Index is now just a few points away from Neutral–imagine that!), very few of the economic challenges that came into stark relief over the last several months have gone away…

With that, we hope you enjoyed, dear Ndaxers, a much-deserved reprieve from markets during your long weekend!

MARKET FUNDAMENTALS

BTC and ETHER Had a Great July

- BTC is up 2.5% WoW, 20% MoM

- ETH is up 4.2% WoW, 60% MoM

- Bitcoin lags relative to some of its Layer 1 peers

- Ethereum performed strongly on optimistic Merge narratives

- ETC (Ethereum Classic) outperformed ETH on speculation that ETH Miners would move over to ETC post-merge to Proof of Stake.

A SECOND Consecutive Quarter of Negative GDP Growth

- The US economy contracted by 0.9% (annualized) relative to Q1 2022.

- Don’t ask us whether this means the US (and by default Canada?) is in a recession; neither the Fed, the White House nor the Bureau of Labour Statistics will agree.

The FOMC Raises Rates 0.75%: Markets Soar

- How is raising rates 3/4s of a percentage point dovish? Expectations!

- In light of scary recent CPI Inflation numbers, markets largely feared the Fed could raise rates by a full percentage point; so when they didn’t, last week’s relief rally ensued.

- July CPI Numbers come out Aug 10th

- Next FOMC Rate meeting schedule for mid-Sept.

If you are planning on attending next week’s Futurist Conference…

- Ndax is a title sponsor!

- Ndax COO Tanim Rasul is one of your keynote speakers.

- HAVE YOU REALLY NOT PICKED UP YOUR TICKETS YET?

- Hurry up: They’re almost sold out!

- Use code Ndax25 for a 25% discount on tix, thank us in person at our booth!

THE TAKEAWAY

In a bizarre continuation of the absurdity that has characterized the world over the last 2.5 years; last week was most definitely ‘here for it’. And if past thin-liquidity summer months are any indicators, a lot can happen in markets when most participants are on vacation or at the beach…

Would we be surprised to see the current rally continue to pick up steam? Not in the least. Would we be surprised to see it fizzle, break down, or chop around? Not at all. Are we continuing to take every short-term move with a grain of salt and a pinch of hopium? You bet!

Welcome to August, don’t forget to wear sunscreen!

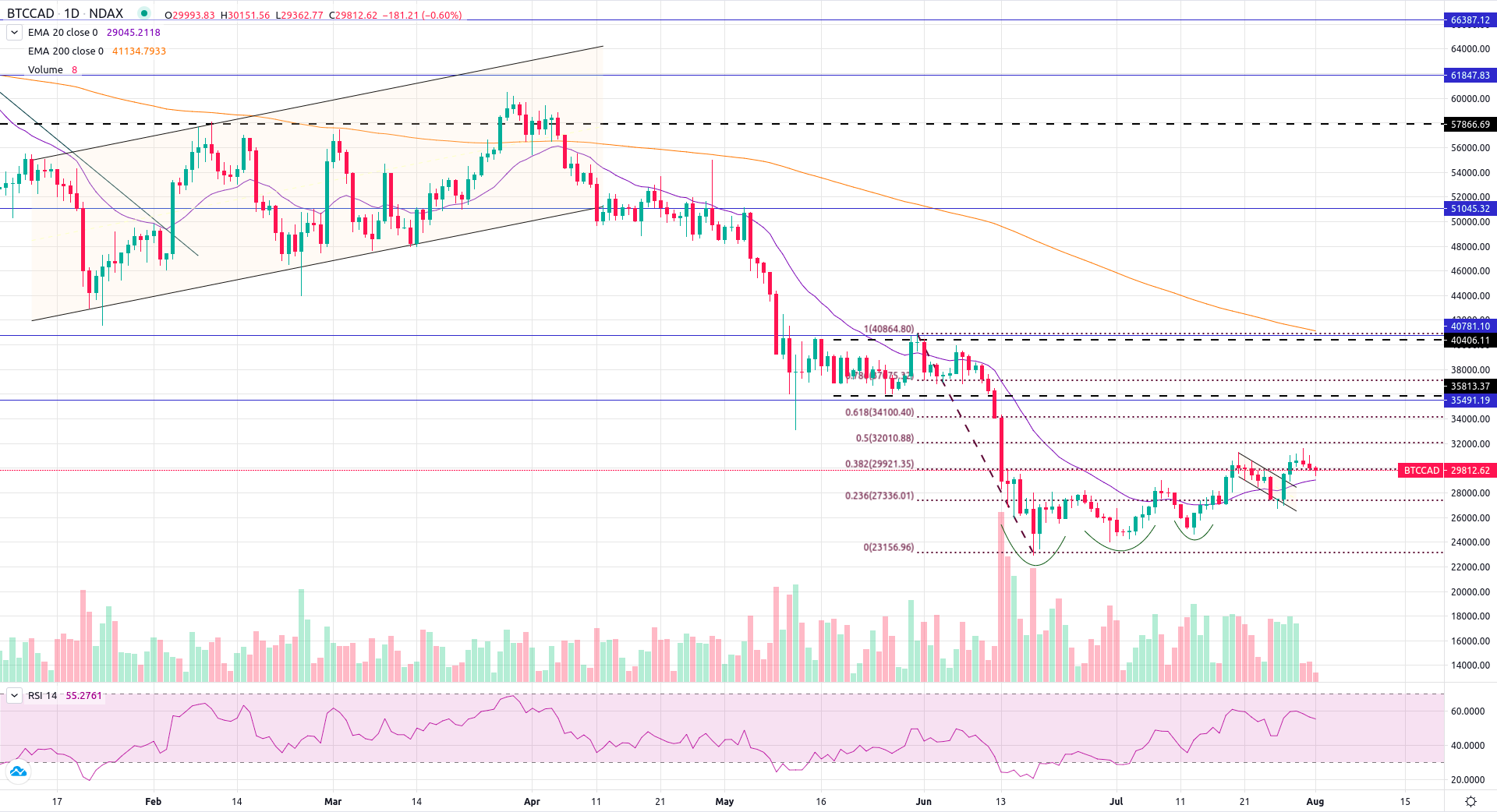

BITCOIN TECHNICAL ANALYSIS

Bitcoin had been consolidating, trading in a range between C$24,500 and C$29,500…

- And finally broke out to a new local high of C$31,500.

- On a daily time frame, recent bottoms are forming ‘Higher Lows and Higher Highs’, indicating a reversal. (Bullish!)

- But BTC is experiencing stern resistance around C$32k.

- If BTC holds its 20-day Moving Average as support…

- We can expect Bulls to push BTC further up to C$35,500, or–

- Down to C$26-30K levels (strong support) if it does not.

KEY LEVELS:

COIN SENTIMENT

Ndax users tirelessly continue to accumulate bitcoin. Half of this week’s transactions on Canada’s favorite Crypto Platform were BUYS.

- BTC sentiment is strong: Almost 4/5ths of orders were BUYS

- LINK, TLM, DOT, AAVE & COMP were weaker: Over half their orders were to SELL

- NEAR and RUNE - Dips are bought: Over half their orders were to BUY

Disclaimer: This content is not intended to provide investment, legal, accounting, tax, or any other advice and should not be relied on in that or any other regard. The information contained herein is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of cryptocurrencies or otherwise.