Weekly Crypto Market Report: February 21-27, 2022

BTC, ETH, LUNA, UNI & More

Market Fundamentals Analysis

The crypto and equities markets have begun to find their footing following the negative price action over the weekend. Risk assets slid yesterday as investors mulled the implications of a military attack by Russia on Ukraine and greater sanctions placed on Russia.

The broader crypto market posted double-digit gains on the weekend. The market rally over the weekend could be a result of investors judging the sanctions against Russia as modest and in turn, proceeding to take on more risk. However, we have seen a correction set in this morning, as markets have started to witness a slight correction.

Moreover, it has been getting cheaper to send ETH these days as the gas price to push a transaction is now 80% less expensive than it was to transact with Ether 48 days ago on January 10. L2 transactions are also cheaper than on-chain transactions since gas fees have plummeted.

Of late, an interesting theme is beginning to emerge where many crypto traders are actually looking for an equities-led selloff as an opportunity to get a better entry. As a result, whenever there is a modest uptick in equities, we actually tend to see strong outperformance in BTC. Crypto still can’t help but track equities here and starting to see more and more fatigue with that reality.

Speaking with our counterparts, the general view is that high correlations during risk-off moves are the expectation, so in an uncertain equity environment, it’s much harder to commit to a substantial position.

Over the past week or so, it appears that retail investors are taking this opportunity and buying the dips more and more, while hedge funds and VCs are less convinced that this dip will end anytime soon and they continue selling. Due to this dynamic, the market is unable to swing in a particular direction and has been rather range-bound.

Amongst leading alts, Terra (LUNA) has seen an impressive rally through the week. The asset saw a rally from lows and closed above the 50-day SMA (C$75). This indicates aggressive buying on dips. The 20-day EMA has turned up and the RSI is in the positive territory, indicating that bulls have the upper hand. There is a minor resistance at C$100. If bulls clear this hurdle, the pair could rally to the overhead zone at C$110 to C$115.

Interestingly, Uniswap (UNI) is up today too. UNI has been on a downtrend since early February, marking consecutive lower highs. However, it bounced off its key support at the C$10.5 level and broke its trendline resistance on Sunday. Since then, the asset has rallied to C$13, and if it crosses the C$15 mark, another rally is likely.

The overall sentiment is that of uncertainty and a lack of control due to the macroeconomic scenario. Global financial markets and crypto markets were pummelling over the past few days as the invasion of Ukraine by Russian forces sent investors scrambling and sell-offs took place across most asset classes.

Bitcoin (BTC) hit a low of $34,333 in the early trading hours on Feb. 24, shortly after the Ukraine incursion began, and has since climbed its way back to $39,000 after an unexpected short-squeeze may have rapped bearish investors on the knuckles, and then correcting again.

Volatility is a given in such a situation, and we can’t really predict where the market will head unless we see a coherently strong and convincing pattern emerge. The next few days remain crucial for the market, as the Russia-Ukraine saga unfolds.

Weekly Snapshot

Market Updates

- The European Commission announced the removal of a number of Russian banks from the Society for Worldwide Interbank Financial Telecommunication (SWIFT).

- The Ukrainian government has reached out to the crypto community on Twitter to raise funds to support its civilians and troops.

- The founder of the $3.4 billion crypto Ponzi scheme Bitconnect has been charged in the United States.

- Private banks in Mexico want to join efforts with the central bank of the country in the creation of a new digital currency.

Bitcoin Technical Analysis

Bitcoin witnessed a sharp fall from C$56,985 to C$44,000. Post this move, the asset is currently consolidating and trading in a broad range from C$50,750 to C$47,000. Breakouts on either side of the range will decide the trend for the asset.

Once BTC breaks and closes above the key resistance of C$51,500, then we can expect the prices to further rally up to C$60,000 levels whereas a close below C$45,000 will lead to further downfall and the prices can slide and test the C$40k mark. A Flat Moving Average and RSI around 50 indicates a neutral stance for the asset.

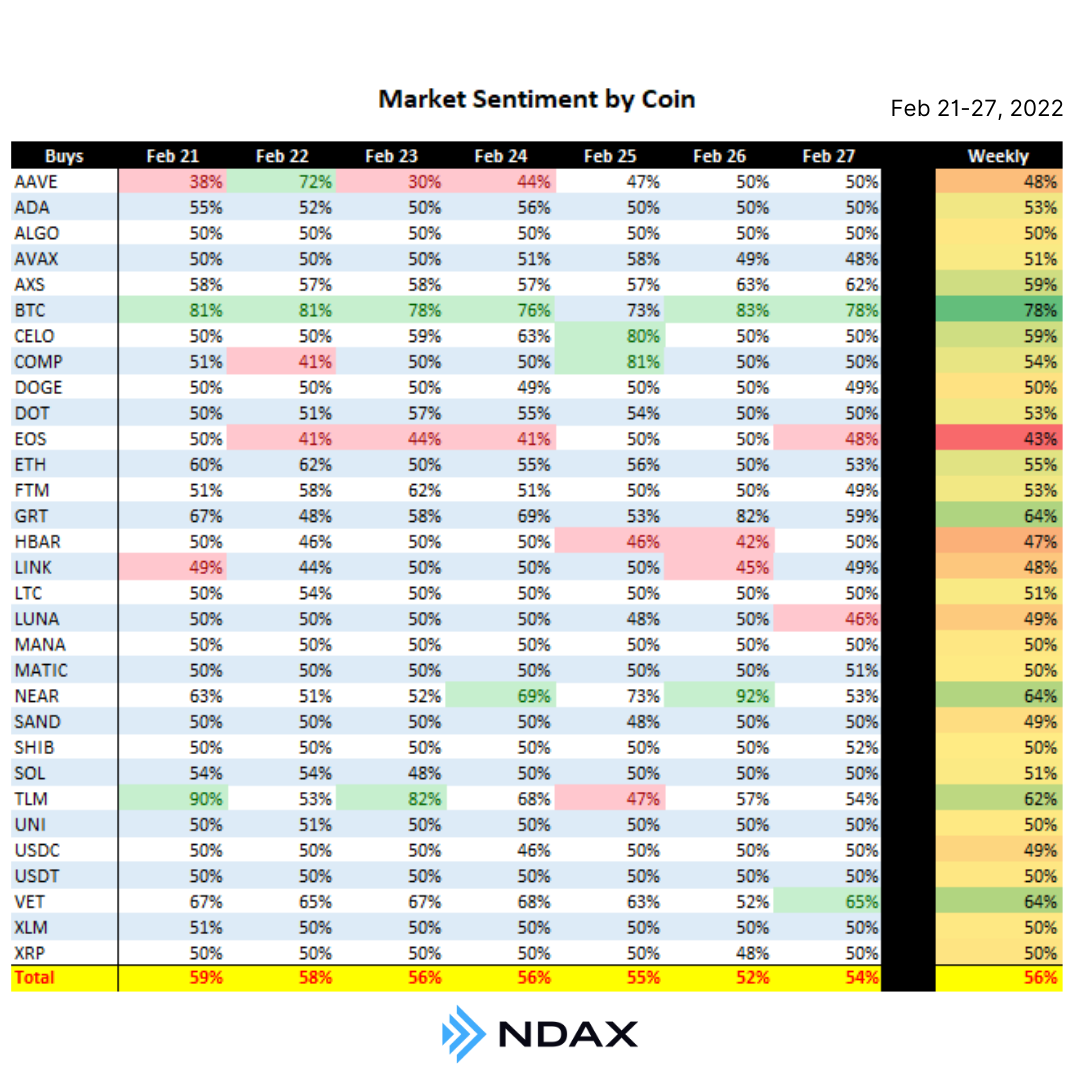

Weekly Sentiment by Coin

Introducing Ndax's weekly market sentiment report by coin. Each week, we'll share the overall crypto sentiment we're seeing across Canada by tracking buy and sell behavior from Ndax traders across the country. The numbers by crypto shown here refer to the percentage of our traders that bought these digital assets over the course of the week, and can reveal overall bullish and bearish patterns.

Looking at this past week, the sentiment towards Bitcoin remains strong with 78% of our traders buying BTC. Additionally, NEAR Protocol (NEAR) and VeChain (VET) which we've just recently added to Ndax also show strong support with 64% of trades last week being buy orders.

On the flip side, HBAR and EOS support were not as strong, with 53% and 57% of those coins' transactions being sell orders, respectively.

Easily track trader behavior per coin each week through Ndax's Market Sentiment chart.

For the latest cryptocurrency prices, check out Ndax's Markets page.

Disclaimer: Information provided in the weekly market report is for information purposes only and should not be interpreted as investment, legal, or tax advice. Prior to investing, it is very important to evaluate your investment objectives and your risk tolerance carefully. This technical report is not meant to provide guarantees of future performance, and users should not rely on it, as the actual performance and financial results may differ significantly.